Gym Chart of Accounts Template (PDF, DOC, XLS – FREE)

Get this free gym chart of accounts template in PDF, DOC, and XLS so you can prepare your gym financial statements and do accounting for your gym.

The Gym Chart of Accounts provides a structured list of financial accounts that are used to manage accounting for gyms, including tracking assets, liabilities, equity, revenue, and expenses. This chart is essential for doing bookkeeping for gyms (check out the guide on the best accounting software for gyms) and serves as the foundation for creating gym financial statements, including the gym balance sheet and the gym profit and loss statement.

For assets, common entries include gym assets such as cash, accounts receivable, and equipment. When considering gym equipment depreciation, it’s important to track the depreciation rate for gym equipment and categorize it under accumulated depreciation. Typically, the gym equipment depreciation life is set to reflect the expected usable period of the equipment, providing a clear view of how much gym equipment depreciates over time and planning out gym equipment maintenance.

The liabilities section covers obligations like accounts payable and unearned revenue, while the equity section tracks ownership interests. For revenue, categories like membership revenue, personal training revenue, and merchandise sales help gyms assess their income sources, while expenses detail all operational costs such as salaries, rent, utilities, and marketing.

Having a well-structured fitness chart of accounts helps gym owners manage their financial data efficiently. For example, knowing how to categorize gym memberships in QuickBooks and tracking fitness equipment depreciation allows for accurate financial reporting and accurate gym sales forecasting (important for creating a gym budget – get a free gym budget template here). Understanding how to value a gym or create a gym financial plan or even how to reduce gym expenses requires accurate representation of gym equipment categories, assets, and depreciation life.

Using this fitness chart of accounts template ensures that the gym’s financial data is well-organized, allowing for smoother tax filings, financial audits, and strategic planning. Understanding gym chart of accounts is key for creating gym financial statements and is an important part of learning how to write a gym business plan, learning how to create a gym budget, and learning how to get a gym loan—all important things to consider as tools for helping you open a new gym.

Learn how to create gym financial statements and get some ideas from the below example gym financial statements. Then be sure to empower yourself with the best gym software for managing a growing gym: Exercise.com.

Example Gym Chart of Accounts

Creating a Chart of Accounts for a gym involves listing out all the accounts where transactions would be recorded. Here’s a basic example, which you may need to adjust based on your specific situation:

Assets

- 1000: Cash

- 1010: Accounts Receivable

- 1020: Prepaid Expenses

- 1030: Inventory

- 1040: Equipment

- 1050: Accumulated Depreciation

Liabilities

- 2000: Accounts Payable

- 2010: Accrued Expenses

- 2020: Unearned Revenue

- 2030: Notes Payable

Equity

- 3000: Owner’s Equity

- 3010: Retained Earnings

- 3020: Drawings

Revenue

- 4000: Membership Revenue

- 4010: Personal Training Revenue

- 4020: Merchandise Sales

- 4030: Vending Machine Sales

Cost of Goods Sold

- 5000: Cost of Goods Sold – Merchandise

- 5010: Cost of Goods Sold – Beverages & Snacks

Expenses

- 6000: Salaries Expense

- 6010: Rent Expense

- 6020: Utilities Expense

- 6030: Office Supplies Expense

- 6040: Equipment Depreciation Expense

- 6050: Marketing & Advertising Expense

- 6060: Insurance Expense

- 6070: Maintenance & Repairs Expense

Remember, the Gym Chart of Accounts can be very detailed or quite simple, depending on the needs and complexity of your gym business. Always consult with a qualified accountant or financial advisor when setting up your accounting system.

Let’s assume this gym has $1,000,000 in annual revenue, and we’ll make some assumptions about its costs and other factors. Remember, these are purely hypothetical and might not represent the actual figures of a real-world gym. You’ll need to adapt these to the specific circumstances of your gym.

Read More:

- How to Create a Gym Business Plan

- How to Create a Gym Budget

- How to Write an Executive Summary for a Gym

How Exercise.com Can Help

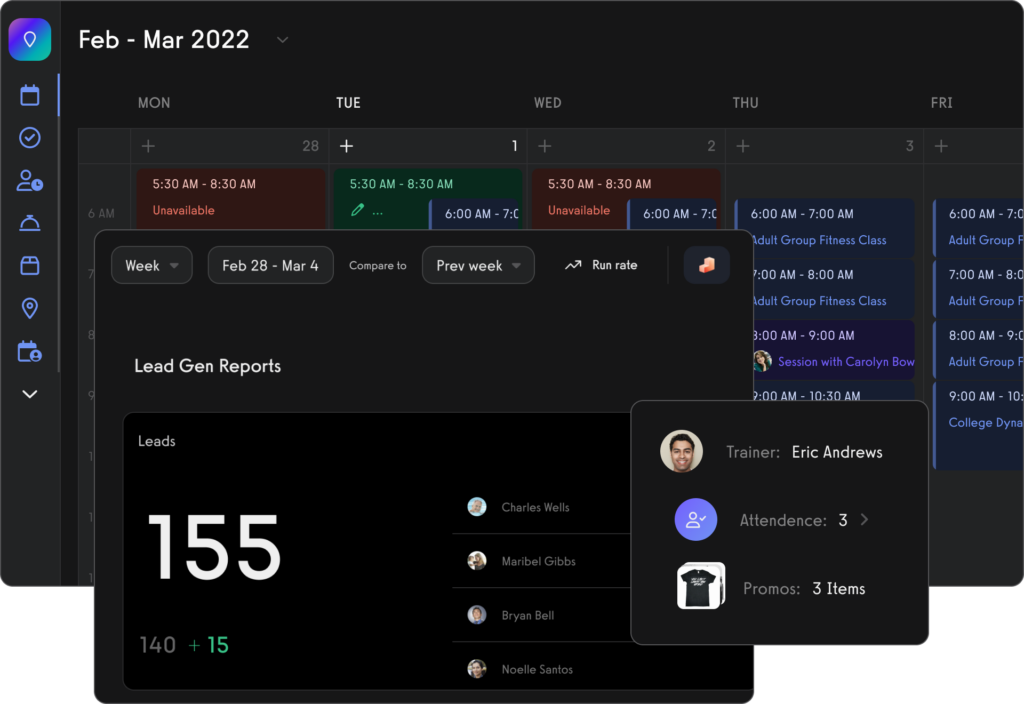

Tired of scrambling around for data? Is your gym accounting a mess? Use the best software for managing a gym with the Exercise.com platform so everything can be nice, neat, and organized.

Mastering Gym Finances: A Comprehensive Gym Chart of Accounts

Gyms and fitness centers have become a vital part of our modern lifestyle, contributing to the overall well-being and physical health of individuals. Behind the scenes, gym owners and managers face various challenges in managing their financial operations efficiently.

One essential tool that plays a crucial role in keeping track of financial transactions is the Chart of Accounts (COA). In this article, we will explore the significance of having a well-structured COA within a gym setting.

Read More:

Definition and Purpose of a Chart of Accounts (COA)

A Chart of Accounts (COA) is a comprehensive list or directory that categorizes all financial transactions within an organization. It serves as the foundation for recording, classifying, and summarizing financial data into meaningful reports.

Each account within the COA represents a specific category or subcategory where financial transactions can be attributed. The purpose of a COA is to provide structure and organization to an organization’s financial records.

By defining specific accounts for different types of transactions, it becomes easier to track income, expenses, assets, liabilities, and equity accurately. Furthermore, it enables efficient analysis and reporting on key financial metrics such as revenue streams, costs incurred, profit margins, and cash flow.

Importance of Having a Well-Structured COA in a Gym Setting

In the dynamic environment of gyms and fitness centers where multiple revenue streams exist alongside various expenses, having a well-structured COA becomes paramount for effective management. Here are some key reasons why:

Accurate Financial Reporting: A properly organized COA ensures that all financial data is recorded consistently across different accounts. This consistency allows for accurate generation of financial statements like balance sheets and income statements which are essential for evaluating business performance.

Facilitates Decision Making: With a well-structured COA, gym managers can access and analyze financial information quickly. This enables them to make informed decisions related to budgeting, cost control, pricing strategies, and investment opportunities.

Eases Tax Compliance: A properly categorized COA simplifies the process of preparing tax returns by segregating different types of income and expenses. It ensures compliance with relevant tax regulations and assists in the smooth conduct of audits or financial inspections.

A well-structured Chart of Accounts is indispensable for gym owners and managers to effectively manage their financial operations. By accurately classifying transactions and organizing financial data, it provides valuable insights into the financial health of the business. The subsequent sections will delve into different categories within a Gym Chart of Accounts, offering a comprehensive understanding of how each component contributes to maintaining sound financial management within a gym setting.

Overview of a Gym Chart of Accounts

A Chart of Accounts (COA) is a systematic listing of the various accounts used by an organization to record its financial transactions. In a gym setting, having a well-structured COA is crucial for effectively managing and tracking financial activities.

A comprehensive COA allows gym owners and managers to classify and categorize different types of financial information accurately. This, in turn, facilitates proper bookkeeping, financial reporting, budgeting, and decision-making processes.

General categories within the COA

The COA in a gym typically consists of several general categories, each serving a specific purpose in organizing the financial data. These categories include Assets, Liabilities, Equity/Owner’s Equity/Net Worth, Revenue/Income, and Expenses/Costs.

Assets

The assets category within the COA represents all the resources owned by the gym that have economic value. This category can be further divided into two subcategories: Current assets and Fixed assets.

a) Current assets

Current assets are those that can be converted into cash or consumed within one year or less. They include cash and cash equivalents such as funds in bank accounts or petty cash on hand.

Additionally, accounts receivable represent any outstanding payments owed by members for services or products provided by the gym. Inventory items like merchandise or supplements available for sale are also considered current assets.

b) Fixed assets

Fixed assets are long-term resources that provide ongoing benefit to the gym over multiple years. These could include land and buildings owned by the gym as well as equipment such as treadmills, weights, machines used for workouts.

Liabilities

The liabilities category in the COA represents any financial obligations or debts owed by the gym. This category can be divided into two subcategories: Current liabilities and Long-term liabilities.

a) Current liabilities

Current liabilities are short-term obligations that are expected to be settled within one year or less. This includes accounts payable, which represent outstanding payments to suppliers or vendors, and any short-term loans or lines of credit that the gym may have.

b) Long-term liabilities

Long-term liabilities encompass financial obligations that extend beyond one year. These typically include mortgages or property loans for gym facilities and long-term equipment financing where the gym may have taken a loan to purchase expensive exercise equipment.

Equity/Owner’s Equity/Net Worth

The equity category in the COA represents the ownership interest in the gym. It reflects the residual interest in assets after deducting liabilities. Two common accounts within this category are Owner’s Capital Account, which records contributions made by owners, and Retained Earnings Account, which accumulates profits retained within the business over time.

Revenue/Income

The revenue/income category tracks all sources of income generated by the gym. This could include various revenue streams such as membership fees, personal training fees, retail sales of merchandise or supplements, and any other services offered by the gym.

Expenses/Costs

The expenses/costs category encompasses all costs incurred by a gym during its operations. This includes expenses related to rent or mortgage payments on facilities, utility bills, staff salaries and benefits, maintenance costs for equipment and facilities, marketing expenses, insurance premiums, and other general operating expenses necessary for running a successful fitness business. A well-structured Chart of Accounts is vital for effective financial management in a gym setting.

The COA categorizes various financial transactions into Assets, Liabilities, Equity/Owner’s Equity/Net Worth, Revenue/Income, and Expenses/Costs. Each category consists of further subcategories and accounts that help organize and track the financial information related to the gym’s operations.

Asset Categories and Subcategories in the Gym COA

Current Assets

Current assets are those that are expected to be converted into cash or used up within a year. In the context of a gym’s Chart of Accounts (COA), current assets play a crucial role in capturing the financial resources readily available to the business. Within this category, there are three significant subcategories worth exploring: cash and cash equivalents, accounts receivable, and inventory.

Cash and Cash Equivalents

Gyms rely on cash flow for daily operations, making it essential to accurately track their liquid funds. Cash and cash equivalents encompass all forms of money held by the gym, including physical currency as well as highly liquid assets such as petty cash or money market funds that can be effortlessly converted into currency. It is crucial to maintain an accurate record of these assets within the COA to facilitate financial management and decision-making processes.

Accounts Receivable

In any business, including gyms, some clients may opt for deferred payment plans or installment arrangements. Accounts receivable represents amounts owed by customers or members who have received services but have not completed their payments yet.

This category captures unpaid membership fees or outstanding invoices for additional services provided by the gym. Creating specific subaccounts within accounts receivable helps monitor outstanding balances and aids in ensuring timely collection efforts.

Inventory (e.g., Merchandise, Supplements)

Gyms often sell merchandise such as branded apparel, nutritional supplements, sports accessories, or even personal care products like protein bars and shakes. Inventory accounts track the cost value of these items held for sale until they are consumed by customers. By accurately recording inventory levels within the COA, gyms can effectively manage stock levels, anticipate demand fluctuations, and make informed purchasing decisions, thereby maintaining optimal profitability.

Fixed Assets

Fixed assets represent long-term tangible resources that gyms use in their operations and are not intended for immediate sale. Under the fixed assets category, two important subcategories to consider are land and buildings, as well as equipment.

Land and Buildings

Gyms typically require dedicated physical spaces to offer their services. Land and buildings form a significant portion of a gym’s assets, encompassing the value of the premises owned by the business.

The COA should include separate accounts for land and building values to accurately reflect their worth and monitor any appreciation or depreciation over time. Additionally, costs related to property maintenance, improvements, or renovations can also be tracked within this subcategory.

Equipment (e.g., Treadmills, Weights, Machines)

Gyms heavily rely on various types of equipment to provide a wide range of fitness activities and exercise programs for their members. This includes treadmills, elliptical trainers, weights (dumbbells, barbells), resistance machines, cardio machines (stationary bikes), and more. Assigning separate accounts within the COA for different types of equipment allows gyms to monitor their investment in these assets accurately.

It also aids in understanding depreciation rates over time as these items wear out due to usage or become outdated with advances in technology. These asset categories and subcategories within a gym’s Chart of Accounts serve as invaluable tools for financial management purposes.

By effectively organizing financial information under these headings, gym owners or managers can gain valuable insights into their cash flow positions, outstanding receivables from clients/membership dues owed by customers/membership payments owed by clients/payment plans with customers/payment plans offered by the gym/stock levels of merchandise/stock levels of nutritional supplements, and the overall value of their fixed assets. Understanding how to manage these assets and track them within the COA enables gyms to make informed decisions regarding resource allocation, pricing strategies, inventory management, and future investments in equipment or facilities.

Liability Categories and Subcategories in the Gym COA

Current Liabilities

Current liabilities in a gym’s Chart of Accounts (COA) refer to obligations that are expected to be settled within one year or the normal operating cycle of the business. These liabilities play a crucial role in tracking short-term financial obligations and managing cash flow effectively. One common example of current liabilities in a gym COA is accounts payable.

Accounts Payable

Accounts payable represent amounts owed by the gym to its suppliers, vendors, or service providers for goods delivered or services rendered but not yet paid for. This category captures expenses such as equipment purchases, maintenance services, utility bills, and other operational costs. Keeping track of accounts payable is essential to ensure timely payments and maintain good relationships with suppliers.

Short-term Loans or Lines of Credit

Another component of current liabilities includes any short-term loans or lines of credit obtained by the gym to meet its immediate financial needs or unforeseen expenses. These loans are usually due within a year and help address temporary cash shortages. Examples may include a business line of credit used for equipment upgrades, repairs, marketing campaigns, or seasonal fluctuations in revenue.

Long-term Liabilities

Unlike current liabilities, long-term liabilities comprise obligations that extend beyond one year from the reporting date on the COA. In a gym’s COA, two prominent subcategories under long-term liabilities are mortgages or property loans and long-term equipment financing.

Mortgages or Property Loans

Gyms often require significant investments in property acquisitions for establishing their facilities. Consequently, many gyms choose to finance these purchases through mortgages or property loans with extended repayment periods spanning several years. These long-term liabilities are captured in the COA to monitor the gym’s overall debt and track monthly or yearly repayments.

Long-term Equipment Financing

To equip their facilities with modern exercise machines, weightlifting equipment, or specialized training tools, gyms may opt for long-term equipment financing. This arrangement allows the gym to acquire costly equipment while spreading the payments over an extended period. The outstanding amount will be reflected as a long-term liability in the COA, and regular payments toward it will be recorded accordingly.

Categorizing and tracking liabilities is essential for any gym’s financial management. Current liabilities such as accounts payable and short-term loans provide insights into short-term obligations, ensuring timely payments and maintaining good supplier relationships.

On the other hand, long-term liabilities like mortgages or property loans and long-term equipment financing reflect the gym’s commitments that extend beyond one year. By maintaining a well-structured Chart of Accounts, gyms can effectively manage their liabilities and make informed financial decisions for sustainable growth.

Equity/Owner’s Equity/Net Worth Category in the Gym COA

Owner’s Capital Account

The Owner’s Capital Account is a crucial component of the Equity category in a gym’s Chart of Accounts (COA). It represents the initial investment made by the owner or owners of the gym.

This account captures the financial value contributed by the owner(s) to start or acquire the business and acts as a reflection of their ownership stake. The Owner’s Capital Account serves as a testament to their commitment and provides a basis for evaluating their overall financial interest in the gym.

Within this account, it is important to record any additional capital injections made by the owner(s) over time. These could include investments made to expand facilities, purchase new equipment, or fund other business initiatives.

Any changes to this account should be carefully documented, allowing for accurate tracking of equity fluctuations. By maintaining an accurate record, gym owners can monitor their personal investment and understand how it impacts overall net worth.

Retained Earnings Account

The Retained Earnings Account is another crucial component within the Equity category of a gym’s Chart of Accounts (COA). This account represents accumulated profits or losses that are retained within the business rather than distributed among owners as dividends or withdrawals.

Retained earnings serve as an indicator of how profitable a gym has been over time and contribute to its overall net worth. When a gym generates profits, these earnings are added to the Retained Earnings Account at the end of each accounting period.

Conversely, if there are losses incurred during any given period, they would be subtracted from this account. Tracking these figures allows for an understanding of historical profitability trends and informs future financial decisions.

It is essential for gyms to diligently maintain accurate records within their Retained Earnings Account since it affects key financial metrics such as return on equity (ROE) and plowback ratio. Additionally, understanding the historical trends of retained earnings is crucial for projecting future growth and determining the capacity to reinvest in the business.

Both the Owner’s Capital Account and Retained Earnings Account are vital components of a gym’s Chart of Accounts. The Owner’s Capital Account reflects the initial investment made by the owner(s) and any subsequent capital injections into the business.

On the other hand, the Retained Earnings Account represents accumulated profits or losses that have been retained within the gym over time. Ensuring accurate recording and tracking of these accounts enables gym owners to assess their personal investment, understand historical profitability trends, and make informed financial decisions for long-term success.

Revenue/Income Categories and Subcategories in the Gym COA

Membership Fees

Membership fees are a crucial source of revenue for any gym, and they typically form the backbone of a gym’s income category in the Chart of Accounts. Within membership fees, there are various subcategories that help track and analyze revenue streams more effectively. The two primary subcategories of membership fees are monthly membership fees and annual membership fees.

i. Monthly Membership Fees

Monthly membership fees represent one of the most common revenue streams for gyms. These fees are charged on a monthly basis to members who have subscribed to ongoing access to gym facilities, services, and amenities. Monthly membership fees provide a stable and predictable income source for gyms as members usually commit to longer-term contracts or recurring payments. To ensure accurate financial tracking, each membership fee payment should be recorded under this subcategory within the Chart of Accounts. This allows gym owners and managers to monitor monthly revenue trends, assess member retention rates over time, and make informed decisions regarding pricing strategies or promotional campaigns.

ii. Annual Membership Fees

In addition to monthly memberships, many gyms offer annual memberships that allow members to pay their dues upfront for an entire year. Annual membership fees provide benefits for both members and the gym itself. Members often receive discounts or special perks by committing to a full year upfront, while gyms benefit from increased cash flow at once. Within the Chart of Accounts’ income category, it is essential to create a separate subcategory specifically dedicated to annual membership fees. This enables effective monitoring of revenue generated from these long-term commitments separately from other income sources like daily passes or personal training sessions.

Setting Up Your Gym Chart of Accounts

The proper categorization of revenue streams in a Gym Chart of Accounts is vital for financial management within fitness establishments. By accurately tracking income categories and subcategories, such as membership fees, gym owners and managers can gain valuable insights into their revenue sources.

This enables informed decision-making, allows for effective budgeting, and supports the overall financial health of the gym. Embracing a well-structured Chart of Accounts ensures transparency and clarity in financial reporting.

By keeping track of membership fees meticulously, gyms can identify trends, evaluate pricing strategies, and understand their revenue streams better. Hence, by maintaining an organized Chart of Accounts focusing on revenue categories like membership fees, gym owners can optimize their operations and pave the way for long-term success.

What is accounts receivable in a gym?

Accounts receivable in a gym represents the money owed to the gym by its members. This could be for services like personal training, classes, or membership fees that have been billed but not yet paid. With the help of Exercise.com’s software, you can manage your gym’s accounts receivable with features like billing, payments, and collections tracking.

What are COGS for a gym?

COGS, or Cost of Goods Sold, for a gym could include costs directly related to providing services to members. This could include things like personal trainer wages, equipment costs, or the cost of items sold at a juice bar or pro shop. Exercise.com’s software can help gyms track these costs for more effective financial management.

What are the monthly expenses for a gym business?

Monthly expenses for a gym business can vary greatly but might include rent or mortgage payments, utility bills, equipment maintenance, staff salaries, marketing costs, insurance, and supplies. Exercise.com’s business management software can help gyms keep track of these expenses.

What are the 5 main account types in the gym chart of accounts?

The five main account types in a gym’s chart of accounts typically include assets, liabilities, equity, revenue, and expenses. Each of these account types helps gym owners understand their financial position and make informed business decisions. Using a system like Exercise.com can help simplify financial management for gym owners.

Is gym equipment a current asset?

Gym equipment is considered a fixed asset, not a current asset. Fixed assets are items of value that a company plans to use over a long period, like gym equipment. Current assets, on the other hand, are items that can be easily converted into cash within a year, like cash on hand or accounts receivable.

What are the liabilities of a gym?

Liabilities of a gym can include accounts payable (money owed to suppliers), salaries payable to employees, loans for purchasing equipment or property, and any accrued expenses like utilities or services.

How do you calculate gym revenue?

Gym revenue can be calculated by adding up all the income generated from gym operations. This can include membership fees, personal training fees, revenue from selling products (like supplements or gear), and any other services or products the gym offers.

What is the average profit of a gym?

The average profit of a gym can vary greatly depending on factors like location, size, services offered, and operating costs. According to industry surveys, gyms can have a profit margin ranging from 10% to 30%. However, with careful financial management and utilization of platforms like Exercise.com, gym owners can maximize their profits.

Read More:

- How to Increase Profit in a Gym

- How profitable is owning a gym?

- Most Profitable Fitness Business Models

How to do accounting for a gym?

To do accounting for a gym, begin by setting up a financial plan for gym business that includes budgeting, forecasting, and financial monitoring. Implement a gym chart of accounts template that categorizes your income, expenses, assets, and liabilities. Regularly track revenue from memberships, classes, and other services, while also managing operating expenses such as rent, utilities, and payroll. Utilize accounting software tailored for gyms to streamline processes, automate billing, and generate financial reports.

Read More: Accounting for Gyms

What is the chart of accounts for a gym membership?

The chart of accounts for a gym membership typically includes categories such as:

- Revenue Accounts: Membership fees, personal training income, class fees, and merchandise sales.

- Expense Accounts: Rent, utilities, payroll, marketing expenses, and equipment maintenance.

- Asset Accounts: Gym equipment, cash, and accounts receivable.

- Liability Accounts: Loans, accounts payable, and unearned revenue.

Using a gym chart of accounts template can help ensure all necessary categories are included for effective financial tracking.

How to prepare a gym chart of accounts in Excel?

To prepare a gym chart of accounts template in Excel:

- Open a new spreadsheet and label the first column “Account Number” and the second column “Account Name.”

- List the account categories (revenue, expenses, assets, liabilities) and their corresponding accounts.

- Assign unique account numbers for easy reference, following a logical numbering system.

- Save the template as a gym chart of accounts template excel for future use and adjustments.

- Optionally, you can create additional columns for descriptions or notes about each account.

How do gyms account for revenue (cash or accrual)?

Gyms typically use the accrual accounting method to account for revenue. This means that revenue is recognized when earned, regardless of when payment is received. For example, if a member signs a contract for a year of services, the gym recognizes the revenue over the course of the year, not just when payments are made. This method provides a clearer picture of the gym’s financial performance and is often preferred for creating accurate gym profit and loss statements.

What is the best accounting software for gyms?

The best accounting software for gyms includes options like QuickBooks, Xero, and Exercise.com’s integrated financial management tools. These platforms offer features specifically designed for fitness businesses, such as membership tracking, invoicing, expense management, and financial reporting. Choosing software that integrates with your gym management system can streamline operations and improve financial oversight.

Read More: Best Accounting Software for Gyms

How do I prepare gym financial statements?

To prepare gym financial statements, follow these steps:

- Gather Financial Data: Collect all relevant financial information, including revenue, expenses, assets, and liabilities.

- Create a Gym Balance Sheet: Summarize your assets, liabilities, and equity to show the gym’s financial position at a specific point in time.

- Prepare a Profit and Loss Statement: List revenues and expenses to determine net profit or loss over a specific period.

- Compile a Cash Flow Statement: Track cash inflows and outflows to understand the liquidity of your gym.

- Review and Adjust: Analyze the statements for insights, making necessary adjustments to your financial strategies.

Read More: Gym Financial Statements

What is the depreciation rate for gym equipment in a gym?

The depreciation rate for gym equipment typically ranges from 10% to 20% per year, depending on the type of equipment and its expected useful life. Commonly, most gym equipment has a useful life of 5 to 10 years. Accurate tracking of gym equipment depreciation is essential for financial reporting and tax purposes, ensuring that the value of assets is appropriately reflected on the gym balance sheet.

Read More:

- Gym Equipment Depreciation Guide

- Gym Equipment Maintenance Checklist

- Gym Equipment Maintenance Guide

How can the best gym management software help my gym accounting?

The best gym management software, like Exercise.com, helps your gym accounting by providing integrated financial tools that streamline billing, invoicing, and revenue tracking. It allows for automated membership renewals and payment processing, reducing administrative workload. Additionally, robust reporting features enable you to generate financial statements, track cost of goods sold for a gym, and manage budgets effectively, making accounting processes more efficient and accurate.