Gym Equipment Depreciation Guide for Gym Owners

Read this gym equipment depreciation guide for gym owners who need to understand the gym equipment depreciation life for commercial gym equipment and learn how much to depreciate gym equipment.

Use this guide on gym equipment depreciation, specifically for how gym owners should depreciate commercial gym equipment to understand one of the most important gym maintenance issues and gym owner tax deductions, key strategies for accounting for gyms, learning how to choose a gym bookkeeper and how to create a gym budget, gym sales forecasting, and all of the gym financial management considerations like what equipment is needed to open a gym, whether to buy or lease gym equipment, and all the other costs to opening a gym, that will contribute to an increase in gym revenue and profit.

It might seem like a lot to keep track of, but it’s important! Here’s what you need to know about depreciating gym equipment.

Read on to discover the essential gym depreciation requirements you need to know. And, of course, we all know that we want to increase gym revenue and profitability, we want to make your gym stand out, we want to motivate gym staff, and be one of the most successful gyms, so be sure to power up your gym business with the best gym management software and the best personal training software: Exercise.com.

Use the professional’s solution for managing a gym: Exercise.com.

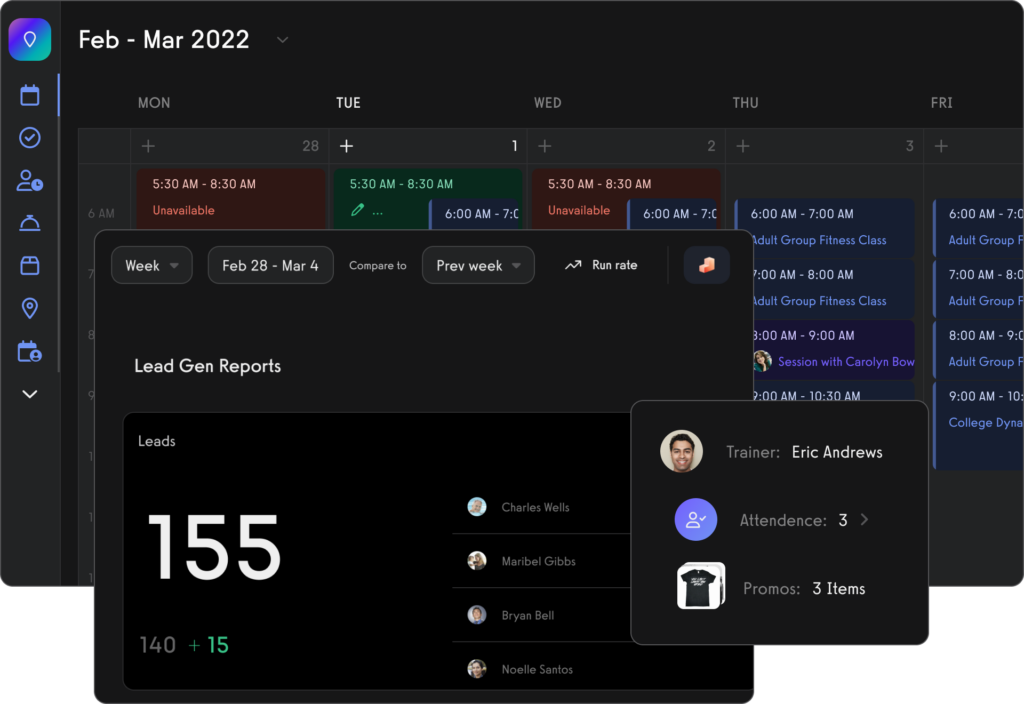

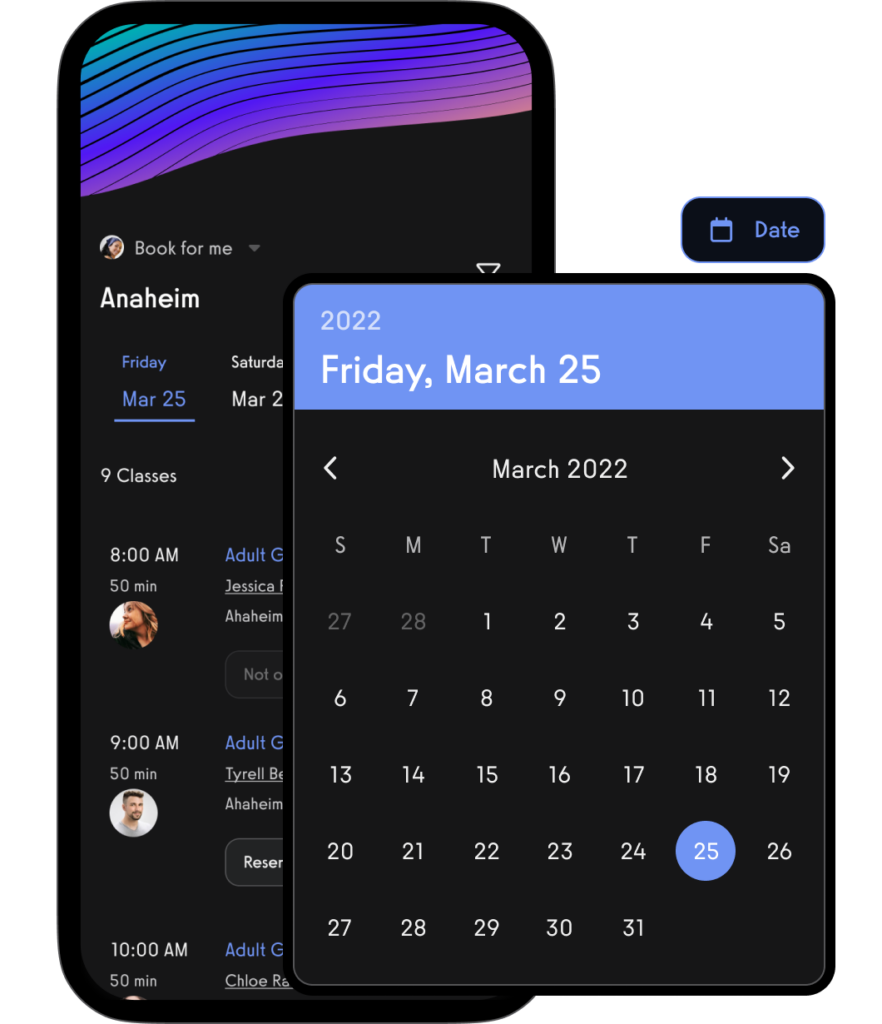

Robust booking and scheduling.

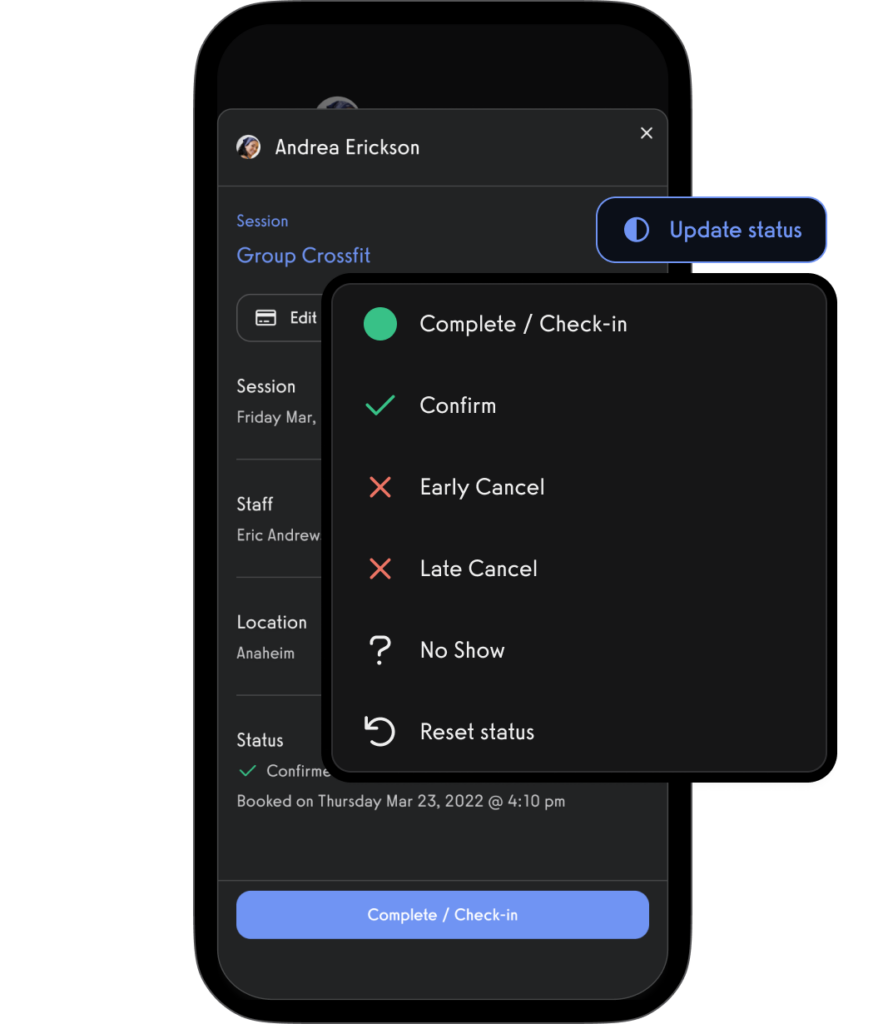

Gym check-ins.

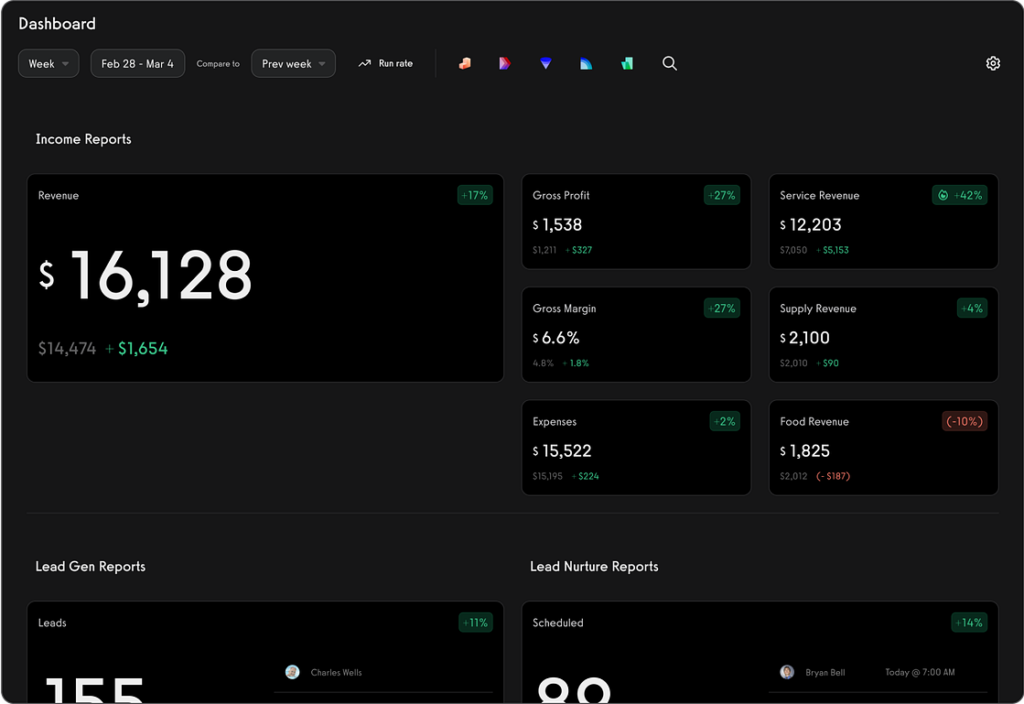

Advanced reporting.

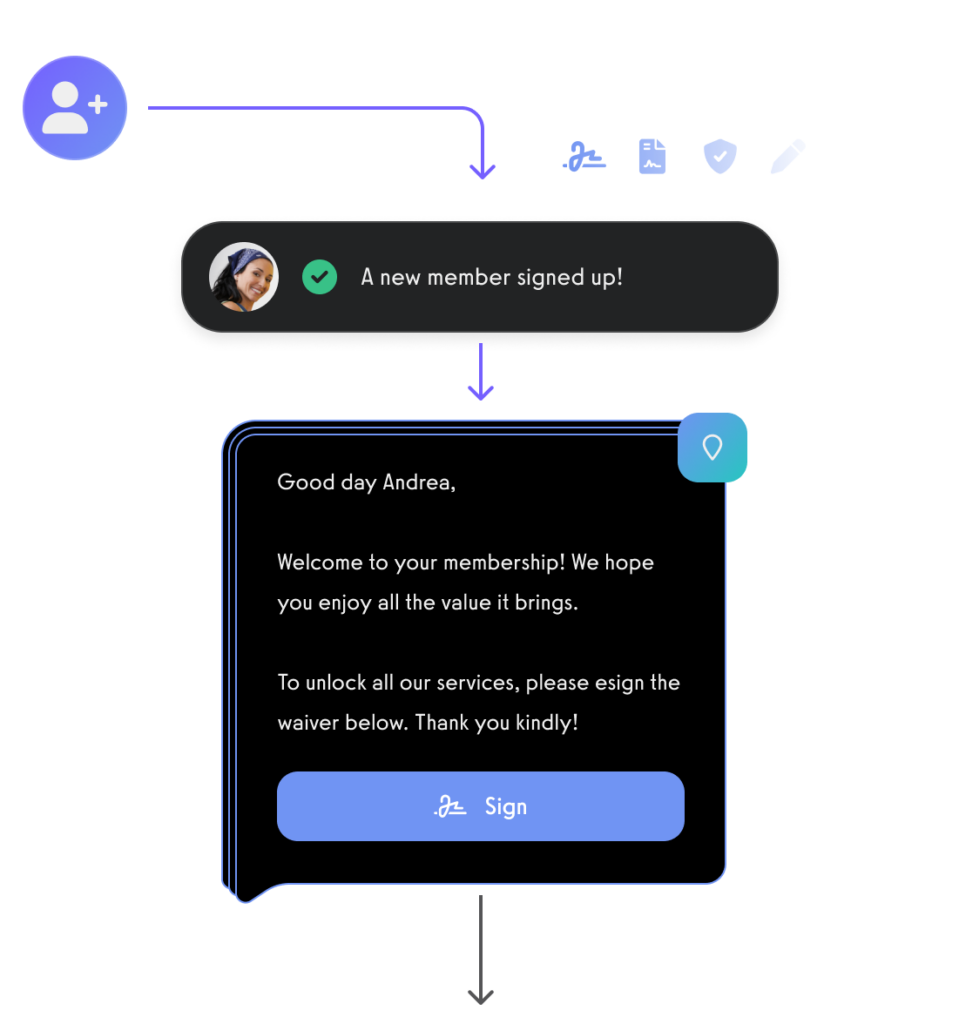

Waivers, assessments, e-signatures, and more to make sure your gym’s legal requirements are buttoned up.

And much, much more.

Understanding Gym Equipment Depreciation

Depreciation is an accounting method that helps business owners allocate the cost of tangible assets over their useful life. For gym owners, understanding how to depreciate gym equipment is vital for accurate financial reporting and tax purposes.

- What is Depreciation?: Depreciation allows you to spread out the expense of a tangible asset over the time it’s expected to be used. For gym equipment, this means allocating the cost over the years during which the equipment helps generate revenue.

- Why is it Important?: Depreciation affects your gym’s financial statements and tax returns. It helps in accurately reflecting the value of your assets and reduces taxable income through depreciation expense.

Types of Gym Equipment Depreciation Methods

- Straight-Line Depreciation: This is the simplest form, dividing the cost of the equipment by its useful life. For example, if a treadmill costs $5,000 and has a useful life of 5 years, its annual depreciation expense is $1,000.

- Declining Balance Method: Faster depreciation in the early years of the asset. It’s a good choice if gym equipment loses its value more quickly due to high usage or technological advancements.

- Units of Production Method: This method is based on usage or output, suitable if the wear and tear on the equipment are more linked to how much it’s used rather than time.

Determining the Useful Life of Gym Equipment

- Manufacturer’s Guidelines: Often, the manufacturer provides an estimated useful life for their equipment.

- Industry Standards: Look at industry norms. Commercial gym equipment typically has a useful life ranging from 5 to 12 years, depending on the type of equipment.

- Usage Patterns: Consider how often the equipment is used and the intensity of use. Equipment in a high-traffic gym depreciates faster than in a smaller boutique gym.

Calculating Gym Equipment Depreciation

- Cost of the Equipment: This includes the purchase price and any additional costs necessary to get the equipment ready for use.

- Salvage Value: Estimate the equipment’s value at the end of its useful life. For instance, a piece of equipment might still have some resale value.

- Apply the Chosen Depreciation Method: Using one of the methods mentioned, calculate the annual depreciation expense.

Gym Equipment Tax Implications

- Tax Deductions: The IRS allows businesses to deduct depreciation on gym equipment. This can provide significant tax benefits.

- Section 179 Deduction: Under certain conditions, you might be able to deduct the full cost of the gym equipment in one tax year instead of depreciating it over several years.

Read More: Gym Owner Tax Deductions

Gym Record Keeping

Maintain accurate records of all your gym equipment purchases, depreciation schedules, and any maintenance costs. This will be important for financial reporting and tax purposes.

Note: It’s important to consult with a tax professional or accountant for specific advice, as tax laws and financial reporting standards can vary and change.

This guide provides a basic framework for understanding and applying depreciation to commercial gym equipment, an important aspect of managing a gym’s finances.

Read More:

Gym Equipment Useful Life

Here is a chart that outlines the estimated useful life and salvage value percentages for different types of gym equipment. This information is crucial for calculating depreciation:

| Equipment Type | Useful Life (Years) | Salvage Value (%) |

|---|---|---|

| Treadmills | 5 | 10 |

| Stationary Bikes | 5 | 10 |

| Weight Machines | 7 | 15 |

| Ellipticals | 5 | 10 |

| Free Weights | 10 | 20 |

Gym Equipment Depreciation Life Formula

The formula for calculating the annual depreciation expense using the straight-line method is:

[ \text{Annual Depreciation Expense} = \frac{\text{Cost of Equipment} – \text{Salvage Value}}{\text{Useful Life}} ]

Example Gym Equipment Depreciation Calculation

Suppose a gym purchases a treadmill for $5,000. According to the chart, a treadmill has a useful life of 5 years and a salvage value of 10% of its cost. The salvage value is $500 (10% of $5,000). Using the formula:

[ \text{Annual Depreciation} = \frac{5000 – 500}{5} = \$900 ]

So, the annual depreciation expense for the treadmill is $900.

Gym Leasehold Improvements Depreciation Life

Leasehold improvements have a different depreciation life compared to gym equipment. Typically, the IRS allows for a depreciation life of up to 15 years for leasehold improvements. This would apply to modifications or enhancements made to the leased gym space, like installing new flooring or lighting.

How to Calculate Gym Equipment Depreciation

I will now create a simple gym equipment depreciation calculator to demonstrate how to calculate depreciation for gym equipment.

Using the provided example for the treadmill:

- Cost of Equipment: $5,000

- Salvage Value: 10% of $5,000 = $500

- Useful Life: 5 years

The annual depreciation expense for the treadmill is calculated as follows:

[ \text{Annual Depreciation} = \frac{5000 – 500}{5} = \$900 ]

Therefore, the annual depreciation expense for the treadmill is $900.

This calculation is a straightforward example of how to use the straight-line method for gym equipment depreciation. The same formula can be applied to other gym equipment by adjusting the cost, salvage value, and useful life according to the specific equipment type.

Here are a few more examples with common gym equipment scenarios:

Example #1: Stationary Bike

- Cost of Equipment: $3,000

- Salvage Value: 10% of $3,000 = $300

- Useful Life: 5 years

The annual depreciation expense for the stationary bike is calculated as:

[ \text{Annual Depreciation} = \frac{3000 – 300}{5} = \$540 ]

Example #2: Weight Machines

- Cost of Equipment: $8,000

- Salvage Value: 15% of $8,000 = $1,200

- Useful Life: 7 years

The annual depreciation expense for the weight machine is calculated as:

[ \text{Annual Depreciation} = \frac{8000 – 1200}{7} \approx \$971.43 ]

Example #3: Free Weights

- Cost of Equipment: $2,000

- Salvage Value: 20% of $2,000 = $400

- Useful Life: 10 years

The annual depreciation expense for the free weights is calculated as:

[ \text{Annual Depreciation} = \frac{2000 – 400}{10} = \$160 ]

These examples demonstrate how to calculate the depreciation expense for different types of gym equipment using the straight-line method. The salvage value percentage and useful life can vary based on the equipment type, as outlined in the initial chart. This approach helps gym owners in gym budgeting and financial planning by providing a clear picture of the equipment’s annual depreciation expense.

- Gym Budget Guide

- Gym Budget Templates

- Best Gym Accounting Software

- Best Gym Software with QuickBooks Integration

- Best Personal Trainer Accounting Software

- How to Reduce Gym Utility Expenses

What is the estimated useful life of gym equipment?

The estimated useful life of gym equipment varies depending on the type of equipment and its usage. Typically, commercial gym equipment can last anywhere from 5 to 12 years with proper maintenance.

What is the lifespan of gym equipment?

The lifespan of gym equipment depends on factors like quality, maintenance, and frequency of use. Commercial-grade equipment generally has a longer lifespan, often lasting 10 years or more.

Read More: Gym Equipment Maintenance Checklist

Does gym equipment hold its value?

Gym equipment, especially high-quality, commercial-grade items, can hold significant value, although it does depreciate over time. The brand, condition, and demand for specific equipment types can influence how well it retains value.

How much do ellipticals depreciate?

Ellipticals depreciate similarly to other fitness equipment. In the first year, they can depreciate up to 50%, and this rate may continue over the next few years. The brand and condition significantly affect the depreciation rate.

Is gym equipment depreciation 5 or 7 years?

For tax purposes, gym equipment is often categorized under the 7-year property class for depreciation. However, the actual depreciation method and schedule can vary, so it’s recommended to consult with a tax professional.

How do you calculate the useful life of gym equipment?

The useful life of gym equipment can be calculated by considering the manufacturer’s estimated lifespan, usage patterns, maintenance schedule, and observing the wear and tear over time.

What is the life expectancy of an elliptical machine?

The life expectancy of an elliptical machine, particularly in a commercial setting, typically ranges from 7 to 12 years, depending on usage and maintenance.

When should gym equipment be replaced?

Gym equipment should be replaced when it shows significant wear and tear, becomes outdated, or frequently breaks down. Regular maintenance and inspections can help determine when replacement is necessary.

How much does fitness equipment depreciate in a commercial gym?

In a commercial gym, fitness equipment can depreciate quickly in the first few years, often around 40-50% in the first year and gradually in the following years. The exact rate depends on the type of equipment and its usage.

What type of asset is gym equipment?

Gym equipment is typically classified as a tangible fixed asset in accounting terms. It’s a long-term asset that provides value to the business over several years.

How much do treadmills depreciate?

Treadmills depreciate at a rate similar to other fitness equipment. They can lose up to 50% of their value in the first year and continue to depreciate over the next few years.

Do treadmills hold their value?

Treadmills can hold a portion of their value, especially if they are well-maintained and from a reputable brand. However, like most fitness equipment, they do depreciate over time.

Should you buy or lease gym equipment?

Whether to buy or lease gym equipment depends on your business’s financial situation, the equipment’s cost, and your long-term plans. Leasing can be beneficial for keeping upfront costs low and equipment updated, while buying is more cost-effective in the long run.

Read More: Buy vs Lease Gym Equipment

What equipment is needed to start a new gym?

To start a new gym, essential equipment includes cardio machines like treadmills and ellipticals, strength equipment like free weights and resistance machines, and functional fitness gear like kettlebells and yoga mats.

Read More: What equipment is needed to start a new gym?

How much does it cost to open a gym?

The cost to open a gym varies widely depending on size, location, and type of gym. Initial costs can range from $10,000 for a small studio to several hundred thousand dollars for a large commercial gym.

Read More: Cost to Open a Gym

How can Exercise.com help me run a gym?

Exercise.com can help run a gym by offering comprehensive software solutions for membership management, scheduling, workout programming, progress tracking, and billing. Its platform streamlines daily operations, enhances member engagement, and provides robust tools for managing and growing your gym business.