How to Get a Gym Loan and Reduce Gym Financing Costs in 2025 (10 Options)

Learn how to get a gym loan with this gym financing guide that explains how to get a business loan for a gym acquisition, how to get a loan to open a gym, and other creative ways to finance a gym.

How do you find the best gym loan? Here’s what you need to know to get a gym loan, and even what to do if you are not approved for a gym loan. Securing funding is one of the biggest challenges when opening a gym, purchasing fitness equipment, or financing a gym franchise. Whether you’re looking for an SBA loan for a gym, merchant cash advance for gyms, or fitness center startup loans, understanding the pros and cons of each gym loan option is crucial. Below is a breakdown of gym loan options to help you determine the best way to finance a gym.

| Loan Type | Pros | Cons |

|---|---|---|

| SBA Loan for Gyms | Low interest rates, long repayment terms, backed by the government. | Lengthy approval process, strict requirements. |

| Traditional Bank Loan | Higher loan amounts, structured repayment plans. | Requires good credit, high documentation demands. |

| Merchant Cash Advance for Gyms | Quick funding, no collateral required. | Higher interest rates, daily or weekly repayments. |

| Equipment Financing | Specifically for purchasing fitness equipment, easier approval. | May require personal guarantee, potential high interest. |

| Business Line of Credit | Revolving credit line, flexible access to capital. | Variable interest rates, potential risk of overuse. |

| Fitness Center Startup Loans | Tailored for new fitness businesses, startup-friendly. | Can have higher interest rates due to startup risk. |

| Gym Franchise Financing | Designed for franchise purchases, structured financial support. | Franchise fees and restrictions apply. |

| Investor or Crowdfunding | No repayment if using equity investors, community-driven funding. | Dilution of ownership, success not guaranteed. |

| Fast Loans for Gyms | Fast approval process, good for urgent expenses. | Potential high interest rates for quick access to funds. |

| Same-Day Loan for Gyms | Immediate funding, accessible for emergency needs. | Extremely high fees, should only be used for short-term emergencies. |

Opening a gym can be a challenging task, and fully understanding the cost to open a gym if you are trying to get a loan to open a new gym is key, or conversely, learning how to value a gym business if you are trying to finance an existing gym business acquisition, but with the right gym business plan coupled with a gym sales forecast that accurately and professionally lays out the financial case to get approved for a gym loan, it can be a very rewarding experience, both professionally and financially.

If you’re looking to secure a business loan for a gym, then understanding your gym financing options is essential. Whether you need a loan for a gym business, funding to open a gym, or fitness equipment financing, having a strong financial plan can help you get approved. Get access to all the free fitness templates you need, including gym financial planning guides, gym budget templates, fitness class risk assessment templates, gym contract templates, and other professional gym templates to help with making sure your gym business is professionally documented and presented for a gym lender to offer funding to your gym.

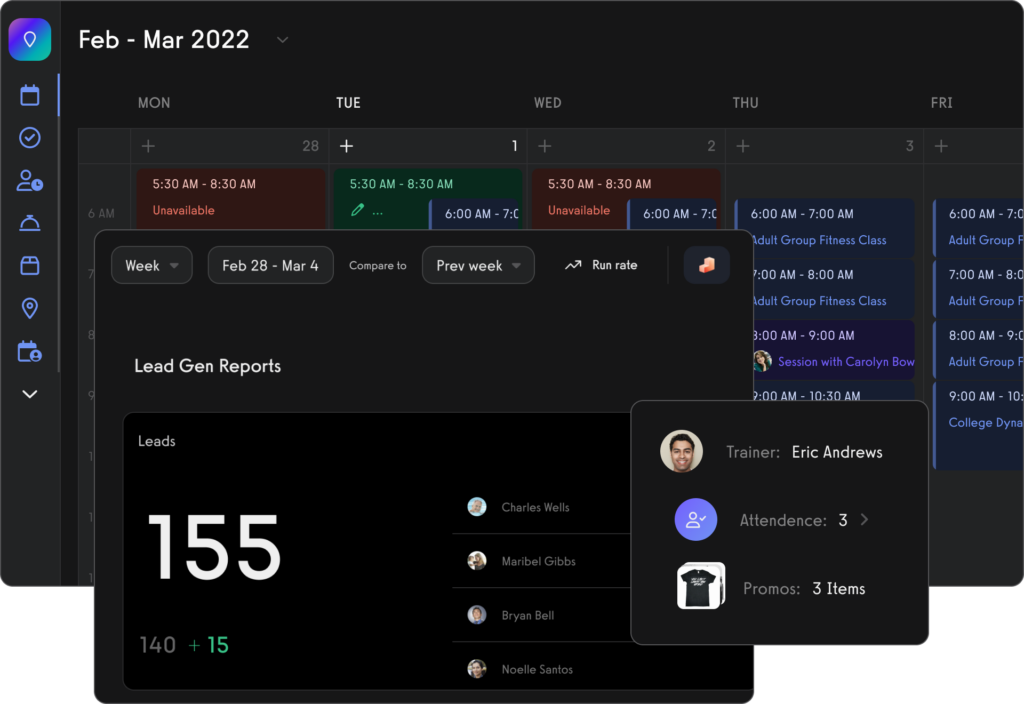

With Exercise.com, you can manage memberships, automate billing, and optimize your gym operations once your funding is secured. Get a demo now and see how our platform helps gym owners streamline business management.

From securing a gym loan project to exploring fitness franchise financing, Exercise.com provides the best gym management software for fitness business owners. Whether you’re looking for financial gym cost estimates, applying for SBA loans for gyms, or financing workout equipment, our platform helps you streamline operations and increase profitability. Get a demo now.

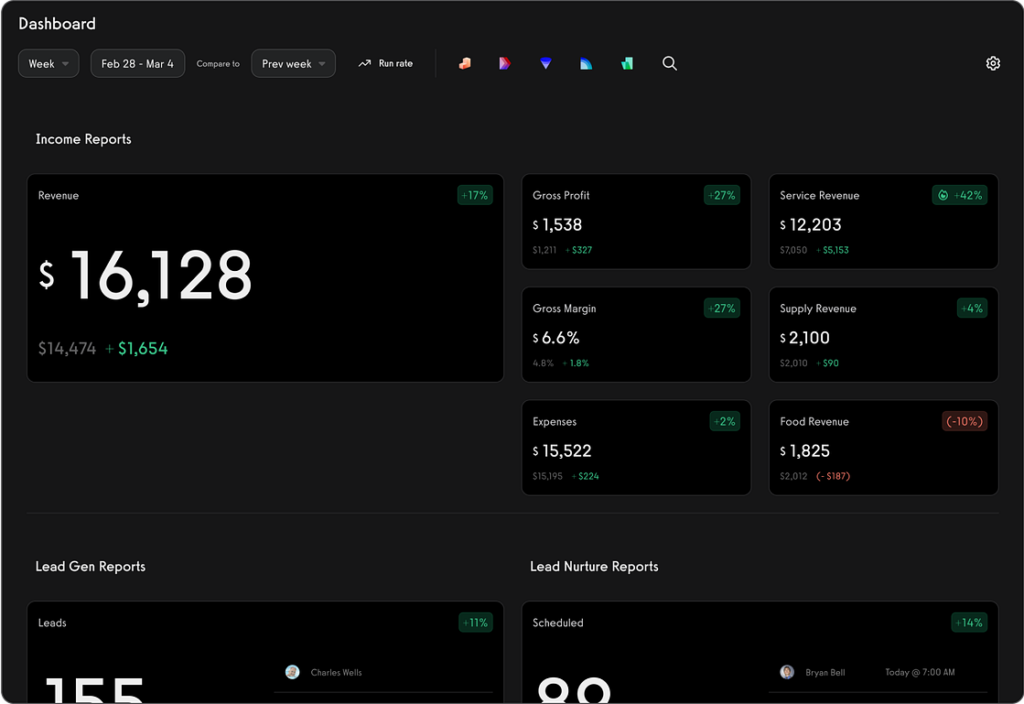

Read through our gym owner guide, check out the world’s best gym business management software, and then get a demo to see how we can help you grow and manage your gym better. To run a professional gym business and present your gym KPI’s and other key gym metrics in a bank and investor-friendly way, then use the best gym reporting software to truly understand your gym’s key metrics that will impact your gym’s ability to get a loan.

And as our reviews from gym owners attest, see why our gym software has gym owners raving (get a free demo here).

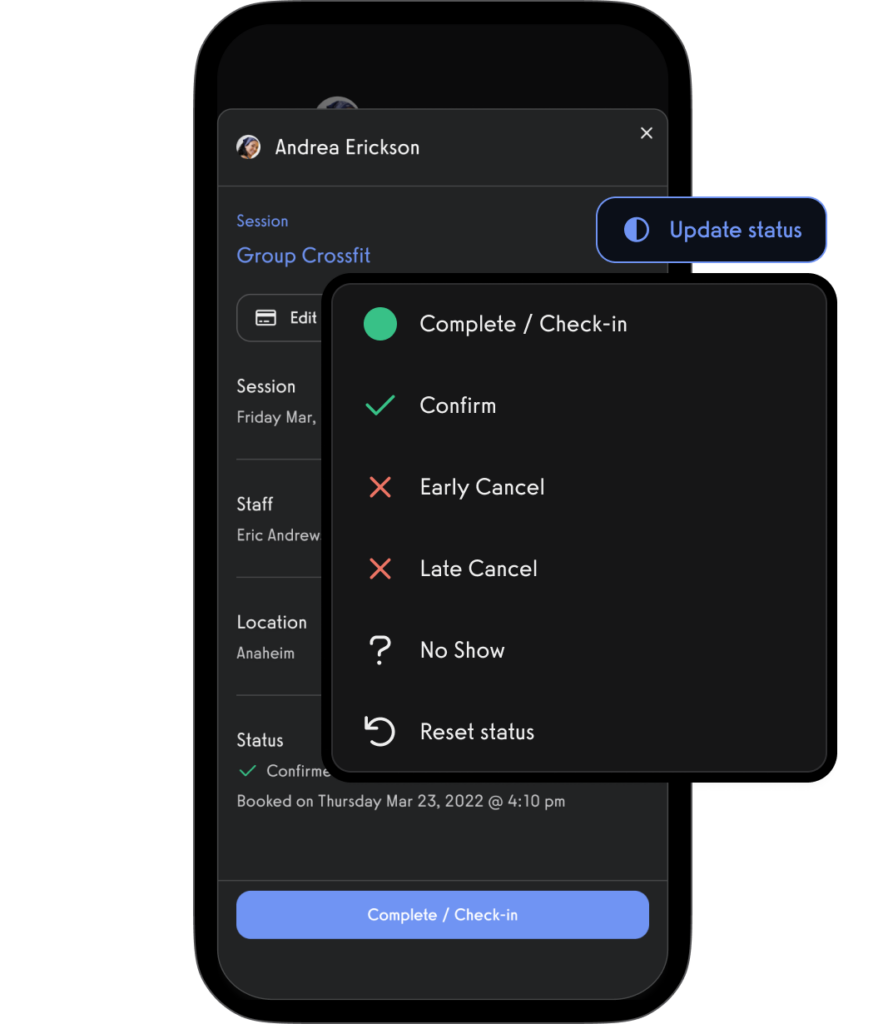

Gym check-in software that makes your life easy. (Read More: Best Gym Check-In Software)

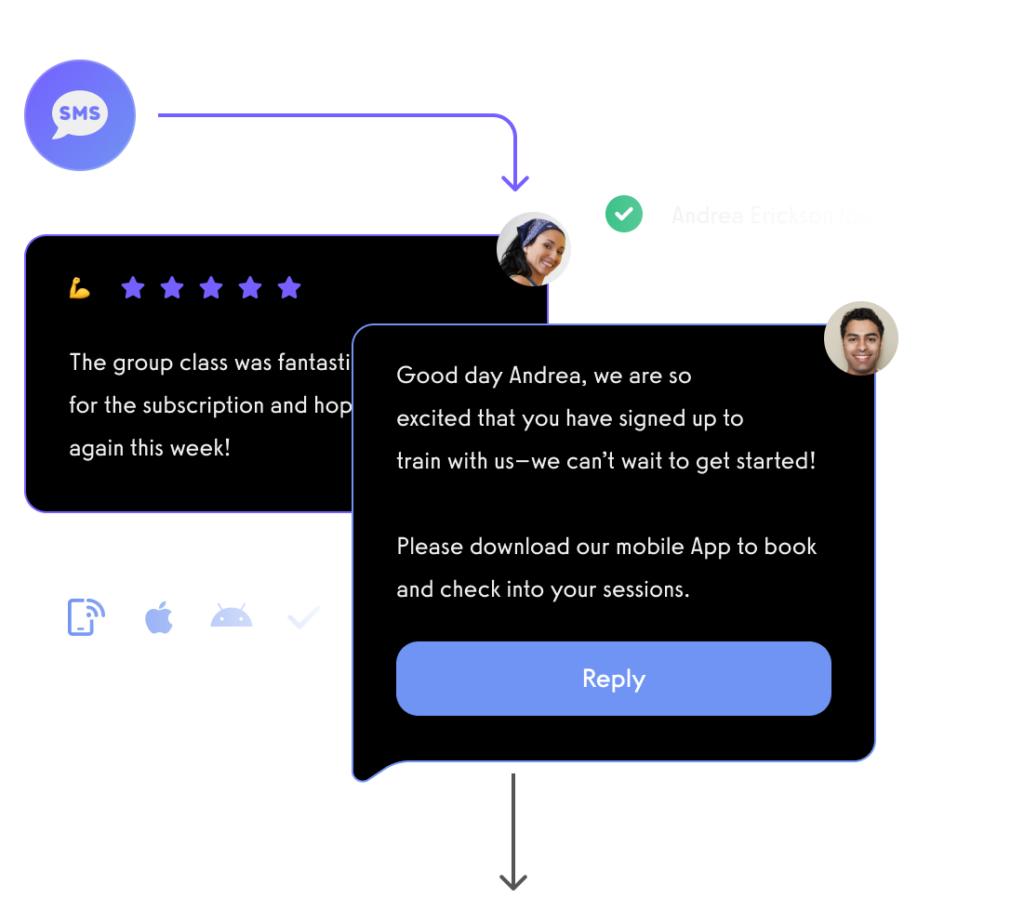

Communicate with gym members, athletes, team members, personal training clients, class members, parents, and dependents via SMS, email, and in-app push notification.

And of course, view all of your gym business reports to get the gym financial data you need to put your best foot forward when applying for a gym business loan, gym line of credit, gym equipment loan, or other gym financing arrangement that requires your gym have accurate and professionally presented gym financials. Be sure to also check out our guide to accounting for gyms, find the best gym software with QuickBooks integration, review the best accounting software for gyms, and even check out our guide to choosing a bookkeeper for a gym (yes, it’s a lot, but getting your gym financials in order before applying for a gym loan is important).

And when you use Exercise.com, you can run your gym and provide a professional experience to your members and clients all from your custom-branded fitness apps (Read More: Best Gym Mobile Fitness Apps Software)

Applying for a Gym Loan

What is a gym loan exactly? A gym loan is a type of business loan that is specifically designed for fitness entrepreneurs who want to start or expand a gym or fitness business (note: a gym loan can be used for gym expansion, not just gym start-up costs). Read on to learn about the steps to get a gym loan and the types of gym loans available to help you start or expand your gym.

So, how do you get funding to open a gym? Options include SBA loans for gyms, merchant cash advances, fitness center startup loans, and even wholesale fitness product financing. If you’re asking, “Can I get a loan to open a gym?” or “How much can I get a loan for a gym franchise?” then working with a gym bank, exploring gym SBA loan programs, and considering fast loans for gyms may be the right approach. Even if you have bad credit, there are options like gym equipment financing bad credit and exercise equipment financing to help you acquire the necessary resources. Whether you’re looking to finance a treadmill with bad credit, secure same-day loans for gyms, or explore yoga studio business loan opportunities, understanding your financing options is crucial.

It’s important to shop around and compare different lenders to find the one that offers the best terms and rates for your business. Keep in mind that the interest rate and terms of a loan can greatly impact the overall cost of the loan and the success of your gym. (Read more about gym profitability).

If you are applying for a gym loan to open a gym, then be sure you understand how much it costs to open a gym. Generally speaking, the cost to open a gym ranges from $5,000 for a modest home-based personal training gym to over $1,000,000 for expansive full-service commercial gyms. Mid-range options like boutique fitness studios and franchise gyms typically cost $100,000 to $500,000 to open, while opening a yoga studio can cost between $15,000 to $50,000.

Okay, let’s get to it. Here’s how you can get a gym loan fast (hopefully).

Step 1: Create a Business Plan

The first step in securing a gym loan is to create a comprehensive gym business plan. A business plan is a document that outlines your business’s goals, strategies, and financial projections. It is an essential tool for getting a loan as it helps lenders understand your business’s potential for success.

When creating your business plan, make sure to include information on the following:

- The Market and Industry: Describe the size of the fitness industry, the target market for your gym, and your competition.

- Your Business Model: Explain how your gym will generate revenue, including membership fees, personal training, and other services.

- Financial Projections: Include detailed financial projections, such as projected income statements, balance sheets, and cash flow statements.

Read More: How do I write a proposal for a gym?

Step 2: Determine the Type of Loan You Need

There are several types of gym loans available, each with their own terms and conditions. The most common types of gym loans include:

- SBA Loans: The Small Business Administration (SBA) offers several loan programs to help small businesses, including the 7(a) loan program, which can be used to finance the purchase of equipment, inventory, and other business expenses.

- Gym Equipment Financing: This type of loan is used to purchase equipment, such as cardio machines, weightlifting equipment, and other gym equipment.

- Commercial Mortgages: These loans are used to purchase or refinance commercial real estate, such as the building where your gym will be located.

- Business Lines of Credit: This type of loan allows you to borrow up to a certain limit and pay interest only on the amount you borrow.

Step 3: Gather Gym Financial Documents

To apply for a gym loan, you will need to provide financial documents to the lender. These documents include:

- Personal and Business Tax Returns: Lenders will want to see your personal and business tax returns to understand your financial situation.

- Financial Statements: You will need to provide financial statements, such as balance sheets and income statements, to show the lender that your business is financially stable.

- Business Licenses and Permits: You will need to provide proof that your business is legally registered and has all the necessary licenses and permits to operate.

Read More:

- Accounting for Gyms

- How to Choose a Gym Bookkeeper

- How to Create a Gym Budget

- Best Accounting Software for Gyms

Step 4: Find a Gym Lender

Once you have a business plan and financial documents, you can start looking for a lender. There are several ways to find a lender for a gym loan, including:

- Banks and Credit Unions: Local banks and credit unions are a great place to start when looking for a gym loan.

- Online Lenders: There are several online lenders that specialize in gym loans, such as SmartBiz and OnDeck.

- SBA-Approved Lenders: The Small Business Administration (SBA) has a list of approved lenders that offer SBA-guaranteed loans.

Step 5: Apply for the Gym Loan

Once you have found a lender, you can apply for the gym loan. The application process for a gym loan is similar to that of any other business loan. You will need to fill out an application form and provide the lender with your business plan and financial documents.

Securing a gym loan can be a challenging task, but with a comprehensive business plan, the right type of loan, and the necessary financial documents, it is definitely possible. It’s important to remember that lenders are looking for businesses that have a high potential for success, so make sure to present your business in the best possible light.

So, what do you do if you get declined for a gym loan? Well, don’t give up hope just yet…

Other Ways to Get Money to Open a Gym

Business loans are a traditional way to finance a gym, but they are not the only option. Other creative ways to get money for a gym besides business loans for a gym include seeking funding from angel investors, crowdfunding, and business incubators. Each option has its own advantages and disadvantages, and it’s important to consider which one is the best fit for your fitness business.

- Angel Investors: Angel investors are wealthy individuals who invest their own money in start-ups and small businesses. They can provide a significant amount of funding and can also offer valuable advice and mentorship.

- Crowdfunding: Crowdfunding is a way to raise money for a business by soliciting small contributions from a large number of people. Platforms such as Kickstarter and Indiegogo allow businesses to create a campaign and collect funds from a wide range of investors.

- Business Incubators: Business incubators provide resources and support to start-ups and small businesses. They may offer funding, office space, and mentorship to help businesses grow and succeed.

Other Creative Ways to Get Money for a Gym

- Pre-Sales! – Get out there and pre-sell gym memberships, packages, and personal training sessions. Train people in a different facility or do a boot camp in a park, but if you want to make it happen, you can do it!

- Friends & Family Funding – Asking your friends and family for money. Yep, sometimes it’s hard to do. Awkward. Maybe even humbling. But often, well, it works.

- Online Training – Who says you need a brick and mortar gym to be a successful fitness business owner these days anyway? Get started with online fitness challenges, sell workout plans online, do fitness livestreaming, or sell online fitness group memberships.

Ways to Finance Gym Equipment

Learning how to get a loan for gym equipment is important. Here are some things you should know about gym equipment loans, and specifically, types of gym equipment loans you should be familiar with.

- Gym Equipment Financing: Equipment financing is a loan that is specifically used to purchase equipment. It can be a good option for gyms because the equipment itself can be used as collateral for the loan.

- Gym Equipment Leasing: Leasing equipment is another option that allows gyms to use equipment without having to purchase it outright. Leasing can be a more affordable option, but gyms will not own the equipment.

- Personal Funds: Many gym owners use their own personal funds to purchase gym equipment. This can be a good option for gyms that have the necessary capital to make the purchase outright.

Read More: Should I lease or buy gym equipment?

Commercial Gym Equipment Financing Options

Financing commercial gym equipment is a crucial step for many gym owners, especially when starting or upgrading their facilities. Choosing the right financing option can significantly impact your gym’s financial health and operational efficiency. Several financing options are available, each with its own set of advantages and drawbacks. Understanding these can help you make an informed decision that aligns with your business needs and financial situation.

Equipment Leasing

Leasing gym equipment is a popular option for many gym owners, offering flexibility and lower upfront costs.

Pros

- Lower Initial Costs: Leasing requires less capital upfront compared to purchasing equipment outright.

- Tax Benefits: Lease payments can often be deducted as business expenses.

- Flexibility: Leasing offers the flexibility to upgrade equipment as needed without significant financial burden.

- Maintenance Inclusions: Some leases include maintenance, reducing additional upkeep costs.

- Conserves Capital: Helps conserve cash for other aspects of the business.

Cons

- Higher Long-Term Cost: Over time, leasing can be more expensive than purchasing equipment.

- No Equity: You don’t build equity in the equipment as you would if you purchased it.

- Contractual Obligation: Leasing contracts may have strict terms that can be limiting.

Leasing can be an excellent option for gyms that need to manage cash flow effectively or those that frequently update their equipment. It offers short-term savings and flexibility, though it might lead to higher costs in the long run.

Equipment Loans

Equipment loans are a straightforward way to finance gym equipment, where the equipment itself often serves as collateral.

Pros

- Ownership: You own the equipment after the loan is paid off, building equity in your assets.

- Potential Tax Benefits: Interest on the loan may be tax-deductible.

- Fixed Payments: Loans typically have fixed payments, making budgeting easier.

- Flexible Terms: Loan terms can vary, allowing for customization to your needs.

- Improves Credit Score: Timely payments can improve your business credit score.

Cons

- Initial Down Payment: A down payment is often required, which can be substantial.

- Interest Rates: Depending on your credit, interest rates can be high.

- Risk of Obsolescence: You risk owning outdated equipment as new technologies emerge.

Equipment loans are suitable for gyms with enough capital for a down payment and those looking to build equity in their equipment. They offer the security of ownership but come with the risk of technological obsolescence.

Vendor Financing

Vendor financing is provided by the equipment manufacturer or seller, often with competitive terms and rates.

Pros

- Convenience: Easy to arrange as part of the equipment purchase process.

- Potential for Better Terms: Manufacturers may offer attractive financing terms to facilitate sales.

- Customized Packages: Vendors may offer tailored financing packages based on your specific needs.

- Possible Discounts: Some vendors offer discounts on equipment when using their financing.

- Streamlined Process: Often a quicker and more integrated process than traditional bank loans.

Cons

- Limited Choices: Tied to purchasing equipment from a specific vendor.

- Potential for Higher Costs: May include hidden fees or less favorable terms compared to independent financing.

- Credit Impact: Like any form of credit, it can impact your credit score if not managed properly.

Vendor financing is an excellent choice for gym owners looking for convenience and potentially favorable financing terms directly from equipment suppliers. However, it’s important to carefully assess the terms and ensure they align with your business’s financial strategy.

Credit Line

A business line of credit offers flexibility, allowing you to borrow funds up to a certain limit and pay interest only on the amount used.

Pros

- Flexibility: Draw funds as needed up to your credit limit.

- Interest on Used Funds Only: Pay interest only on the amount borrowed, not on the entire credit line.

- Reusable Credit: As you repay the borrowed amount, your credit becomes available again.

- Emergency Fund: Can be used as a safety net for unexpected expenses.

- Quick Access to Funds: Usually faster access to funds compared to traditional loans.

Cons

- Variable Interest Rates: Rates can fluctuate, affecting your repayment amounts.

- Potential for Misuse: Easy access to funds can lead to overspending.

- Regular Payments Required: Requires discipline to make regular payments to avoid high-interest debt.

A credit line can be a versatile tool for gym owners needing flexible access to capital. It’s ideal for covering short-term cash flow gaps or unexpected expenses but requires careful financial management to avoid long-term debt.

Choosing the Right Gym Equipment Financing Option

Selecting the right financing option for your gym’s equipment is critical to your business’s financial health. Whether you opt for leasing, an equipment loan, vendor financing, or a credit line, each option has its pros and cons. It’s essential to consider your gym’s current financial situation, future growth plans, and how the financing choice will impact your overall business strategy.

For gym owners using Exercise.com, the platform can be a valuable tool in managing finances and making informed decisions. Its robust features can help track expenses, monitor cash flow, and integrate with accounting software, providing a comprehensive view of your financial health. By combining smart financing choices with effective management tools like Exercise.com, you can ensure your gym is well-equipped and financially sound for the long term.

List of Types of Gym Financing Lenders and Banks

- Traditional Banks: Traditional banks offer a variety of loans for businesses, including small business loans, SBA loans, and equipment financing.

- Gym Equipment Financing Companies: Equipment financing companies specialize in providing loans for equipment purchases.

- Online Lenders: Online lenders such as Kabbage, OnDeck, and LendingClub offer small business loans and other types of financing.

- Alternative Lenders: Alternative lenders such as merchant cash advance providers and peer-to-peer

What to Watch Out for with Gym Loans

When applying for a loan to open a gym, it’s important to be aware of the potential risks and pitfalls. Some things to watch out for include high-interest rates, long repayment terms, and strict repayment schedules. Additionally, be sure to read and understand the terms and conditions of the loan, as well as any fees and penalties that may be associated with the loan. It’s also important to have realistic projections and a solid business plan in place to ensure that you can repay the loan.

When applying for a fitness business loan, make sure to shop around and compare different lenders to find the one that offers the best terms and rates for your business. Keep in mind that the interest rate and terms of a loan can greatly impact the overall cost of the loan and the success of your business.

Starting or expanding a gym can be a rewarding experience, but it also requires a significant investment. A gym loan can help you finance your business, but it’s important to take the time to create a comprehensive business plan, determine the right type of loan, gather financial documents and find the right lender. With the right preparation and a solid plan, you can secure a gym loan and take the first step towards realizing your dream of owning a successful gym.

Costs to Consider in Gym Financing

When planning to finance a gym, there are several key costs to consider. These costs range from initial setup expenses, like equipment and rent, to ongoing operational costs, such as staff salaries and software subscriptions. Being aware of these costs is crucial for creating a realistic budget and ensuring the financial viability of your gym.

Equipment Costs

Investing in quality gym equipment is one of the most significant expenses for a new gym. This includes cardio machines, weightlifting equipment, and other fitness accessories.

- Cardio machines (treadmills, ellipticals)

- Weightlifting equipment (free weights, machines)

- Fitness accessories (mats, resistance bands)

Securing durable and versatile equipment can be a substantial upfront cost but is essential for attracting and retaining members. Consider leasing options or purchasing used equipment to manage costs.

Read More:

- What equipment is needed to start a gym?

- Gym Equipment Depreciation Guide

- Buying vs Leasing Gym Equipment

- Where to Buy Gym Equipment

Rent or Mortgage Payments

The cost of leasing or buying a property for your gym is a major financial consideration. Location and size significantly impact this expense.

- Lease agreements for commercial space

- Mortgage payments if purchasing property

- Utility costs (electricity, water, heating)

Choose a location that balances affordability with accessibility for your target market. Ensure the space is adequate for your gym’s offerings and potential growth.

Read More:

Staff Salaries

Hiring qualified staff, including personal trainers, class instructors, and administrative personnel, is essential for the smooth operation of your gym.

- Personal trainers and instructors

- Front desk and administrative staff

- Cleaning and maintenance staff

Offer competitive salaries to attract skilled professionals. Consider the number of staff needed based on your gym’s size and services.

Read More: How to Hire Gym Staff

Gym Management Software

Investing in the best gym management software helps streamline operations, from scheduling to membership management.

- Membership management features

- Scheduling and booking systems

- Payment processing capabilities

Software like Exercise.com can enhance operational efficiency and improve member experience. Choose a system that aligns with your gym’s specific needs.

Read More:

Marketing and Advertising

Effective marketing and advertising are crucial for attracting new members and establishing your gym’s brand.

- Digital marketing (social media, email campaigns)

- Traditional advertising (flyers, local ads)

- Promotional events and offers

Allocate a budget for ongoing marketing efforts and track the return on investment to adjust strategies accordingly.

Read More:

Insurance Costs

Gym insurance is necessary to protect your business from liability and property damage.

- Liability insurance

- Property insurance

- Worker’s compensation insurance (if applicable)

Consult with insurance professionals to ensure adequate coverage for your gym’s specific risks.

Read More:

Licenses and Permits

Obtaining the necessary licenses and permits is a legal requirement for operating a gym.

- Business licenses

- Health and safety permits

- Zoning permits (if applicable)

Research the specific requirements in your area and include these costs in your initial budget.

Read More:

Facility Upkeep and Maintenance

Regular maintenance and upkeep of your gym ensure a safe and appealing environment for members.

- Equipment repair and maintenance

- Cleaning services

- Facility upgrades and repairs

Set aside a budget for ongoing maintenance to keep your gym in top condition.

Read More: Gym Equipment Maintenance Checklist

Utility Bills

Utility bills, including electricity, water, and heating, are recurring expenses for any gym.

- Electricity (lighting, equipment usage)

- Water (showers, cleaning)

- Heating and air conditioning

Consider energy-efficient solutions to manage these costs effectively.

Technology and Connectivity

Technology expenses, such as Wi-Fi and entertainment systems, enhance the member experience.

- High-speed internet

- Music and entertainment systems

- Security systems

Invest in reliable technology to support a modern, connected gym environment.

Inventory and Supplies

Stocking your gym with necessary supplies, from cleaning products to fitness accessories, is an ongoing cost.

- Cleaning supplies

- Office supplies

- First aid and safety equipment

Maintain an inventory of essential supplies to ensure smooth daily operations.

Professional Services

Hiring professionals for services like accounting, legal advice, and consulting can be crucial for business management.

- Accounting services

- Legal consultation

- Business consulting

While these services incur costs, they provide valuable expertise for managing your gym effectively. Consider these services as investments in the stability and growth of your business.

Read More:

How to Get a Gym Loan with Bad Credit

Securing a gym loan with bad credit can be challenging, but it’s not impossible. Here are some steps and tips to help you navigate this process:

Understand Your Credit Situation

Before seeking a loan, it’s important to understand your credit status and why it’s considered bad. Obtain a copy of your credit report and review it for any errors or areas you can improve.

Explore Lender Options

Different lenders have varying criteria for loan approval. Consider the following options:

- Alternative Lenders: Some lenders specialize in loans for individuals with bad credit. They often have higher interest rates but more flexible approval criteria.

- Credit Unions: Being member-focused, credit unions might offer more lenient lending terms compared to traditional banks.

- Online Lenders: They may provide more lenient credit requirements and faster approval processes than traditional banks.

Prepare a Strong Business Plan

Lenders will be interested in how you plan to use the loan and how you will repay it. A robust business plan can show your commitment and the potential for your gym to succeed. The plan should include:

- Market Analysis: Demonstrating an understanding of your target market and competition.

- Financial Projections: Detailed projections of cash flow, profits, and expenses.

- Marketing and Growth Strategies: How you plan to attract and retain gym members.

Offer Collateral

Offering collateral can improve your chances of loan approval. Collateral is an asset that the lender can seize if you default on the loan. This could be equipment, real estate, or other valuable assets.

Consider a Co-Signer

A co-signer with good credit can significantly increase your chances of getting approved for a loan. The co-signer agrees to take responsibility for the loan if you default, which reduces the risk for the lender.

Look into Government Programs

Some government programs offer loans or grants to small business owners, including those with less-than-perfect credit. Research options like Small Business Administration (SBA) loans, which are designed to help small businesses get started.

Be Prepared for Higher Costs

With bad credit, you may face higher interest rates or more stringent loan terms. Be prepared for these additional costs and ensure that your business plan accounts for them.

Build and Improve Your Credit

Working to improve your credit score can increase your chances of securing a loan. This can include:

- Paying Bills on Time: Consistently paying bills on time can help boost your credit score.

- Reducing Debt: Lowering your debt-to-income ratio can make you a more attractive candidate to lenders.

Use Technology to Your Advantage

Utilizing tools like Exercise.com can help streamline your gym’s operations and financial management, making your business more appealing to lenders. By showing that you are investing in efficient management software, you demonstrate your commitment to operational excellence and financial responsibility.

Persistence and Preparation

Getting a gym loan with bad credit requires persistence, thorough preparation, and exploring various lending options. By understanding your credit situation, preparing a strong business plan, considering alternative lenders, and possibly enlisting a co-signer, you can improve your chances of loan approval. Additionally, using comprehensive management tools like Exercise.com can further strengthen your business proposition to potential lenders. Remember, improving your credit score should be a continuous process, as it can open more doors for financing in the future.

Learning How to Finance a Gym Business Responsibly

Opening a gym requires a significant investment, and one way to finance your business is by obtaining a loan. To get a loan to open a gym, you will need to present a comprehensive business plan that outlines the costs of starting a gym and the projected income and expenses. And most importantly, that you know how to open a gym. Basically, that you know what you are doing! Additionally, lenders will typically require financial documents such as personal financial statements, tax returns, and credit scores.

Learning how to get a loan for a gym might be hard, but you can do it with the right capital partner on your side. It’s important to shop around and compare different lenders to find the one that offers the best terms and rates for your business. Keep in mind that the interest rate and terms of a loan can greatly impact the overall cost of the loan and the success of your business.

Building a gym also requires a significant investment and obtaining a loan can help you finance your business. To get a loan to build a gym, you will need to present a comprehensive business plan that outlines the costs of building a gym and the projected income and expenses. Additionally, lenders will typically require financial documents such as personal financial statements, tax returns, and credit scores.

You now know enough to be dangerous when it comes to finding a gym loan. Be sure to work with a professional advisor, banker, attorney, accountant, or other financial expert to provide personalized guidance for your particular situation and needs.

How do I get money to open a gym?

To get money to open a gym, you can explore several financing options. These include traditional bank loans, Small Business Administration (SBA) loans, personal loans, or seeking investors. Crowdfunding and community funding initiatives are also viable options, especially if you have a strong network. Pre-selling memberships or offering corporate wellness programs can generate initial revenue. For effective financial management and to improve your loan approval chances, using comprehensive gym management software like Exercise.com is beneficial. It offers tools for business planning, financial forecasting, and managing operational expenses, which can strengthen your business proposal to lenders and investors.

How can I get a gym loan online?

To get a gym loan online, start by researching lenders that offer online financing options for businesses. Look for financial institutions or lending platforms specializing in gym business loans or fitness center loans. You’ll need to prepare a detailed business plan and financial statements to submit with your application. Platforms like Exercise.com can be instrumental in this process, providing data-driven insights and reports to bolster your application. Online loan applications typically require less paperwork and offer quicker approval times compared to traditional bank loans.

How can I get a gym loan with bad credit?

Getting a gym loan with bad credit can be challenging but not impossible. Consider the following options:

- Alternative Lenders: Look for lenders who specialize in bad credit business loans. These lenders are often more flexible but may charge higher interest rates.

- Secured Loans: Offer collateral to secure the loan, reducing the lender’s risk.

- Co-signer or Guarantor: Having a co-signer with good credit can improve your chances of loan approval.

- Government Programs: Explore government-backed loan programs that offer more lenient credit requirements.

- Microloans: Smaller loan amounts through microloans can be easier to obtain.

Prepare to demonstrate your gym’s potential profitability and have a solid business plan, which can be effectively managed using tools like Exercise.com, to show lenders that you’re a worthwhile investment despite your credit history.

How much does it cost to finance gym equipment?

The cost of financing gym equipment will depend on the type of financing and the lender. Equipment financing typically has a lower interest rate than a small business loan, but the terms and rates can vary greatly among different lenders. Additionally, leasing equipment may be more affordable than purchasing it outright, but gyms will not own the equipment. It’s important to compare different options and understand the total cost of the financing over time.

How much does it cost to open a gym?

The cost to open a gym varies, typically ranging from $50,000 for a small gym to over $1 million for a larger facility. Factors affecting this include location, size, type of gym, and the level of equipment and amenities provided. For detailed budgeting, consider gym business capital requirements, including costs for leasing space, purchasing equipment, and initial marketing. Utilizing business loans for gyms or a government loan for gym can help in managing these substantial startup costs.

How to get the gym equipment on loan?

To get gym equipment on loan, explore fitness equipment finance options offered by gym finance companies or consider a fitness equipment loan from a financial institution. Some suppliers provide finance for gym equipment directly, allowing for installment-based repayments. Workout equipment financing can be a practical solution, especially when starting a new gym with substantial equipment needs.

How to afford gym equipment?

Affording gym equipment can be managed through various financing options such as fitness equipment finance or exercise equipment finance options. A loan for gym setup, specifically for equipment, can help spread the cost over time. Additionally, leasing equipment instead of buying outright can be a cost-effective way to equip your gym without a large upfront investment.

How much investment is needed to start a gym?

The investment needed to start a gym can vary widely. For a small gym, initial costs can range from $50,000 to $100,000, while a larger facility with more equipment and amenities may require an investment of several hundred thousand dollars. Key factors include leasing or buying space, equipment costs, staff salaries, and marketing expenses. Securing a business loan to open a gym or seeking gym business funding can help cover these initial costs.

Do gym owners make a lot of money?

The income of gym owners varies based on the size, location, and type of gym they operate. Owners of successful gyms in prime locations with a strong membership base can make a substantial income. However, profitability depends on effective gym management, marketing strategies, and the ability to control operational costs. Utilizing comprehensive management software like Exercise.com can help maximize profits by streamlining operations and enhancing member engagement.

Do you need a downpayment for a gym loan?

The requirements for a gym loan will vary depending on the lender and type of loan. Some traditional bank loans may require a down payment, while other types of financing may not. Additionally, some lenders may require collateral such as equipment or real estate to secure the loan. It’s important to understand the requirements of the loan and ensure that you can meet them before applying.

What about seller financing for a gym loan?

Seller financing is when the seller of a business provides some or all of the financing for the purchase. This can be a good option for gyms that are already established and have a strong customer base. However, it’s important to thoroughly review the terms and conditions of the seller financing and understand the risks and benefits of this type of loan.

Are there government grants for opening a gym?

There are a variety of government grants available to small businesses, including gym start-ups. The Small Business Administration (SBA) offers a variety of grants and loan programs, including the 7(a) loan program and the Community Advantage loan program. Additionally, state and local governments may offer grants for small businesses in certain industries. It’s important to research the available grants and understand the requirements and qualifications for each one.

Read More: Grants for Gyms

Are there small business grants for gyms?

In addition to government grants, there are a variety of private foundations and organizations that offer small business grants for gyms. These grants can provide funding for equipment, expansion, and other business costs. Examples of organizations that offer small business grants include the National Gym Association, the International Health, Racquet & Sportsclub Association, and the National Fitness Trade Organization.

Read More: Grants for Gyms

What types of loans are available for gym owners and fitness businesses?

There are several types of loans available for gym owners and fitness businesses, including:

- Small Business Administration (SBA) loans: These government-backed loans offer favorable terms and lower interest rates for qualified small businesses, including gyms and fitness centers.

- Traditional bank loans: These loans can be used for a variety of purposes, such as buying equipment or expanding your facility. However, they may require a higher credit score and collateral.

- Equipment financing: This type of loan is specifically designed for purchasing gym equipment and usually comes with lower interest rates and flexible repayment terms.

- Business lines of credit: These revolving credit lines can be used for various business expenses, such as inventory or payroll, and may offer more flexibility than traditional loans.

- Merchant cash advances: These short-term financing options provide cash in exchange for a portion of your future credit card sales, which can be useful for businesses with fluctuating revenues.

How do I determine the amount of money I need for my gym loan?

To determine the amount of money you need for your gym loan, consider the following factors:

- Equipment costs: Calculate the cost of purchasing, leasing, or upgrading gym equipment, such as treadmills, weights, and fitness machines.

- Facility expenses: Include costs for leasing or purchasing a commercial space, as well as any necessary renovations or improvements.

- Operating costs: Estimate your monthly expenses, such as utilities, staff salaries, and insurance premiums, to ensure you have enough working capital.

- Marketing and advertising: Allocate funds for promoting your gym, including online and offline marketing efforts.

- Contingency fund: Set aside a buffer for unexpected expenses or fluctuations in revenue, especially during the initial stages of your business.

By adding up these costs, you can determine the total amount you need to borrow.

What is the typical interest rate and repayment period for a gym loan?

Interest rates for gym loans can vary depending on the lender, your creditworthiness, and the type of loan. For example, SBA loans typically offer lower interest rates, ranging from 5% to 10%. Traditional bank loans may have slightly higher rates, between 6% and 15%, while equipment financing and business lines of credit can fall anywhere between 8% and 30%. Merchant cash advances tend to have the highest rates, sometimes exceeding 40%.

Repayment periods also vary, with SBA loans offering terms up to 25 years for real estate purchases and 10 years for equipment financing. Traditional bank loans typically have repayment terms between 3 and 10 years, while equipment financing terms may range from 2 to 7 years. Business lines of credit and merchant cash advances usually have shorter repayment periods, often between 6 months and 2 years.

How can I increase my chances of getting approved for a gym loan?

To increase your chances of getting approved for a gym loan, consider the following tips:

- Develop a solid business plan: Lenders want to see a well-prepared business plan that outlines your goals, target market, and financial projections.

- Improve your credit score: A higher personal and business credit score can increase your chances of loan approval and secure better terms.

- Offer collateral: Providing collateral, such as real estate or equipment, can reassure lenders that their investment is secure.

- Demonstrate cash flow: Show lenders that your gym generates consistent revenue and can afford to repay the loan.

- Seek professional help: Consult with a financial advisor, accountant, or your gym bookkeeper to help you prepare the necessary documentation and strengthen your loan application.

What documents and financial statements do I need to prepare when applying for a gym loan?

When applying for a gym loan, you may be required to provide the following documents and financial statements:

- Business plan: A comprehensive plan that details your gym’s mission, target market, marketing strategy, and financial projections.

- Personal and business credit reports: Lenders will want to review both your personal and business credit history to assess your creditworthiness.

- Financial statements: You’ll need to provide profit and loss statements, balance sheets, and cash flow statements for at least the past two years (if applicable).

- Tax returns: Lenders typically request both personal and business tax returns for the past two to three years.

- Business licenses and permits: Provide copies of any necessary licenses, permits, or certifications required to operate your gym.

- Ownership and legal documents: Include any articles of incorporation, partnership agreements, or franchise agreements that pertain to your gym.

- Collateral documentation: If you’re offering collateral, provide proof of ownership and an appraisal or valuation.

It’s important to have these documents organized and readily available to streamline the application process and demonstrate your professionalism to potential lenders.

Are there any specific lenders that specialize in gym loans or fitness industry financing?

While many traditional banks and lending institutions offer loans to small businesses, including gyms and fitness centers, there are also specialized lenders that focus on the fitness industry. These lenders may have a deeper understanding of the unique challenges and opportunities within the industry and may be more willing to provide financing. Some examples include:

- Live Oak Bank: Offers SBA loans specifically tailored for fitness businesses, including gym owners and personal trainers.

- Ascentium Capital: Provides equipment financing and leasing options for fitness centers.

- Balboa Capital: Offers equipment leasing, working capital loans, and franchise financing for fitness businesses.

When seeking financing, it’s a good idea to explore both general and specialized lenders to find the best terms and options for your gym.

How long does the gym loan application process typically take, and when can I expect to receive the funds?

The gym loan application process can vary greatly depending on the type of loan and the lender. For example, SBA loans are known for their thorough application process and may take several weeks or even months to be approved and disbursed. Traditional bank loans can take anywhere from a few weeks to a couple of months, while equipment financing and business lines of credit may have a faster turnaround, often within a few days to a few weeks.

To expedite the process, ensure that all required documents and financial statements are prepared and organized before submitting your application. Additionally, maintaining open communication with the lender and promptly responding to any requests for additional information can help speed up the process.

What factors do lenders consider when evaluating the creditworthiness of a gym business?

When evaluating the creditworthiness of a gym business, lenders typically consider the following factors:

- Credit score: Both personal and business credit scores play a significant role in determining loan eligibility and terms.

- Business history: Lenders may favor established businesses with a track record of success and profitability.

- Cash flow: Demonstrating consistent and positive cash flow indicates that your gym can afford to repay the loan.

- Collateral: Providing collateral, such as equipment or real estate, can reduce the lender’s risk and increase your chances of approval.

- Debt-to-equity ratio: A lower debt-to-equity ratio indicates that your business has a healthy balance between debt and equity financing.

- Business plan: A well-prepared business plan can help lenders understand your gym’s potential for growth and profitability.

Can I use a gym loan to finance equipment purchases, renovations, or working capital needs?

Yes, gym loans can be used to finance a variety of business needs, including equipment purchases, renovations, and working capital. Equipment financing, in particular, is specifically designed to

help gym owners purchase or lease fitness equipment, such as treadmills, weights, and workout machines. Renovations and expansions, such as adding new workout spaces or upgrading locker rooms, can also be funded through gym loans.

Working capital loans can help cover day-to-day expenses, such as payroll, utilities, and inventory. These loans are particularly useful for managing cash flow during slow periods or when unexpected expenses arise. In general, gym loans can be tailored to meet the specific needs of your fitness business and can be used to support various aspects of its operations and growth.

Are there any alternative financing options for gym owners if a traditional loan is not an option?

If a traditional gym loan is not an option, there are several alternative financing options available for gym owners, including:

- Crowdfunding: Platforms like Kickstarter and Indiegogo allow you to raise funds for your gym through contributions from the public. This method can help you generate interest in your business while also providing capital.

- Peer-to-peer lending: Online platforms like LendingClub and Prosper connect borrowers with individual investors willing to provide loans. These platforms may offer more flexibility than traditional banks.

- Business credit cards: Although not ideal for long-term financing, business credit cards can provide short-term working capital and may come with rewards or cashback programs.

- Angel investors and venture capital: Seeking investment from angel investors or venture capital firms can provide significant funding in exchange for equity in your gym business. This option may be more suitable for businesses with high growth potential.

- Grants: While not as common in the fitness industry, there may be government or private grants available for small businesses, particularly those promoting health and wellness initiatives.

Exploring these alternative financing options can help you secure the necessary funds to launch, expand, or maintain your gym business.

How hard is it to get a loan for gym equipment?

Getting a loan for gym equipment can vary in difficulty, often depending on your credit score and business plan. Exploring options like a fitness loan or workout loan from financial institutions, and fitness equipment loan options from specialized lenders, can be effective routes. Lenders typically look for solid business plans and financial stability, so having a well-prepared proposal can increase your chances of approval.

How can I get a government loan for a gym?

To get a government loan for gym, start by researching available government funding programs that support small businesses, including fitness centers. These programs often offer gym loan subsidy options with favorable terms. Preparing a compelling business plan and demonstrating your gym’s potential for success are key to securing this funding. Leveraging tools and data from platforms like Exercise.com can strengthen your application by providing detailed operational and financial plans.

What credit score is needed for a gym equipment loan?

The credit score required for a gym equipment loan typically varies with lenders, but generally, a score of 600 or above is preferred. Higher scores can lead to more favorable loan terms and lower interest rates. It’s important to check specific requirements with the lender, as some may offer workout equipment financing options for those with lower credit scores.

What credit score is needed for a gym loan to open a gym?

For a gym loan to open a gym, lenders usually look for credit scores in the good to excellent range, typically around 670 or higher. However, options like business loans for physical fitness centers might have different criteria. It’s advisable to improve your credit score to secure better financing terms or explore alternative funding options if your score is lower.

What can I do if I can’t afford a gym?

If you can’t afford a gym, consider alternatives like outdoor workouts, home exercise routines, or online fitness programs. For those in the fitness business, explore options like partnering with investors, applying for business loans for gyms, or seeking smaller-scale fitness center loans. Additionally, platforms like Exercise.com offer cost-effective solutions for managing online fitness services, which can be a lower-cost alternative to a physical gym.

How do cheap gyms make money?

Cheap gyms make money by operating on a high-volume, low-cost business model. They focus on attracting a large number of members at a lower membership fee, relying on the fact that not all members will use the gym regularly. These gyms often minimize expenses by offering fewer amenities and requiring less staff. Additionally, they may generate revenue through add-on services, such as personal training sessions or selling fitness merchandise.

Read More: How do cheap gyms make money?

What are the average expenses of a gym owner?

The average expenses of a gym owner include lease or mortgage payments, utility bills, staff salaries, equipment maintenance, insurance costs, and marketing expenses. Other costs can involve gym management software subscriptions and professional services like accounting or legal assistance. Efficiently managing these expenses is crucial for maintaining profitability, and platforms like Exercise.com can assist gym owners in streamlining these operational costs.

Read More: What are the average expenses of a gym owner?

How to open a gym franchise with no money?

Opening a gym franchise with no money can be challenging but not impossible. Consider options like securing a business loan to open a gym, finding investors, or exploring gym funding opportunities. Some franchises may offer financing options or partnerships. It’s important to have a solid business plan and to understand the financial commitment involved in opening a franchise gym.

Read More: How to Start a Gym with No Money

How much money can you make opening a gym?

The amount of money you can make opening a gym varies widely based on the gym’s location, size, membership fees, and operational efficiency. Successful gym owners can generate substantial profits, but it requires effective business strategies, excellent service quality, and consistent member engagement. Utilizing gym management software like Exercise.com can enhance these aspects, potentially increasing profitability.

Can you make money owning a gym franchise?

Yes, you can make money owning a gym franchise, especially if it’s a well-known brand with a proven business model. Franchises benefit from brand recognition, established operational systems, and ongoing support, which can lead to higher chances of success. However, franchise fees and adherence to franchisor guidelines are important financial and operational considerations.

Read More: Can you make money owning a gym franchise?

How much do gym franchise owners make?

The income of gym franchise owners varies, depending on the franchise’s popularity, location, and the owner’s business acumen. While some gym franchise owners achieve significant profitability, others may see more modest earnings, especially in competitive markets or if the franchise has high ongoing fees.

Read More: Pros and Cons of Owning a Gym Franchise

How can Exercise.com help me run a successful gym business?

Exercise.com can help you run a successful gym business by providing comprehensive gym management software solutions. This includes features for membership management, workout plan creation, scheduling, billing, and reporting. The platform’s versatility caters to various gym types, whether you’re running a small boutique studio or a large franchise. By streamlining operational tasks and enhancing member engagement, Exercise.com aids gym owners in focusing on growth and profitability.

The Gym Owner’s Ally

Finding a gym loan isn’t easy, but we believe in the initiative and persistence of gym owners, because we see it in action every day. Having the right gym software is an important tool to accomplish your gym growth goals.

We help gym owners every day. Reach out for a demo and see how we can help you.