Platform

Solutions

Industries

Compare

Resources

Posted by on June 3, 2023 — Updated on August 30, 2024

Compare the best personal trainer insurance options from NEXT, Geico, ACE, and more.

Learn how to get personal trainer insurance cheap, get personal trainer insurance reviews, compare personal trainer insurance cost, and more. Finding the best personal trainer insurance is crucial for protecting your fitness business from potential liabilities and ensuring peace of mind. With a variety of options available, it’s essential to compare key features such as cost, credibility, online availability, and reviews.

You can save up to 25% in discounts on business insurance for gyms, personal trainers, and online fitness professionals.

Read on for the top personal trainer insurance providers, including NEXT, Geico, ACE, Progressive, and Hiscox, to help you make an informed decision.

| Insurance Provider | Cost | Credibility | Online Availability | Reviews |

|---|---|---|---|---|

| NEXT Personal Trainer Insurance | Affordable | High | Yes | Positive, comprehensive |

| Geico Personal Trainer Insurance | Moderate | High | Yes | Positive, well-known |

| ACE Personal Trainer Insurance | Moderate | High | Yes | Positive, trusted in industry |

| Progressive Personal Trainer Insurance | Affordable | High | Yes | Positive, extensive |

| Hiscox Personal Trainer Insurance | Moderate | High | Yes | Positive, professional |

When selecting insurance, it’s also important to streamline your business operations with the best gym software and the best personal training software. Exercise.com stands out as the premier choice for fitness professionals, offering comprehensive tools to manage clients, schedule sessions, and track progress. By integrating top-tier software with reliable insurance, you can ensure the success and growth of your fitness business.

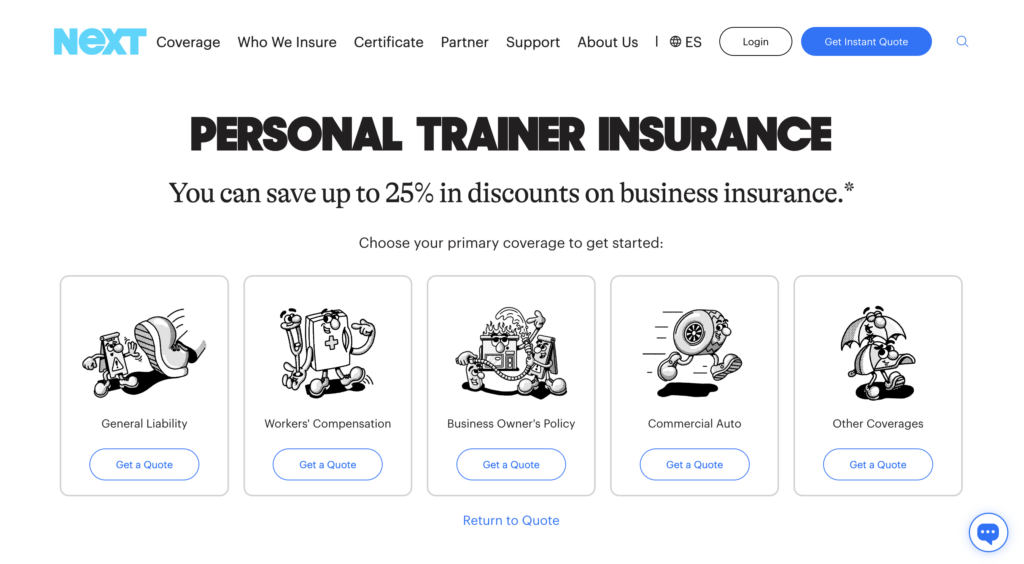

NEXT Personal Trainer Insurance offers comprehensive coverage designed specifically for fitness professionals like personal trainers and gym owners. Known for its affordability and ease of access, NEXT provides a range of options to suit various needs and budgets.

You can save up to 25% in discounts on business insurance for gyms, personal trainers, and online fitness professionals.

NEXT offers free personal trainer insurance quotes, making it easier for trainers to get a clear idea of their potential expenses. With a strong focus on affordability, it’s an excellent option for those looking for personal trainer insurance cheap without compromising on quality. The online platform is user-friendly, providing easy access to policy management and claims, which is crucial for busy professionals.

NEXT’s credibility in the industry is bolstered by positive personal trainer insurance reviews, highlighting their excellent customer service and comprehensive coverage options. Trainers can customize their policies to fit their specific needs, whether they’re working independently or as part of a larger organization. By integrating their insurance with Exercise.com, trainers can further streamline their business operations, ensuring they have both the financial protection and the best tools to manage their fitness business efficiently.

Using Exercise.com as your software solution, you can seamlessly manage clients, schedule sessions, and track progress, complementing the protection provided by NEXT Personal Trainer Insurance. This combination ensures that your business runs smoothly and is safeguarded against potential risks.

You can save up to 25% in discounts on business insurance for gyms, personal trainers, and online fitness professionals.

Geico Personal Trainer Insurance is a well-known option among fitness professionals, offering solid coverage and a reputable name. Geico’s policies are designed to protect personal trainers from various liabilities, ensuring that their businesses remain secure.

Geico provides a comprehensive personal trainer insurance guide that helps trainers understand the necessary coverage for their business. The online platform allows for quick and easy access to personal trainer insurance quotes, making it convenient for trainers to compare rates and choose the best option. Geico’s credibility is bolstered by numerous positive personal trainer insurance reviews, highlighting their reliable customer service and comprehensive coverage.

The personal training insurance cost with Geico is moderate, providing a good balance between affordability and extensive coverage. Trainers can rely on Geico’s reputation and solid customer support to ensure their business is well-protected. By integrating their insurance with Exercise.com, personal trainers can benefit from the best gym software, streamlining their operations and enhancing their client management capabilities.

Exercise.com provides the best personal training software, allowing trainers to efficiently manage their clients, schedule sessions, and track progress. This integration with Geico’s reliable insurance ensures that trainers have both the protection and the tools they need to succeed.

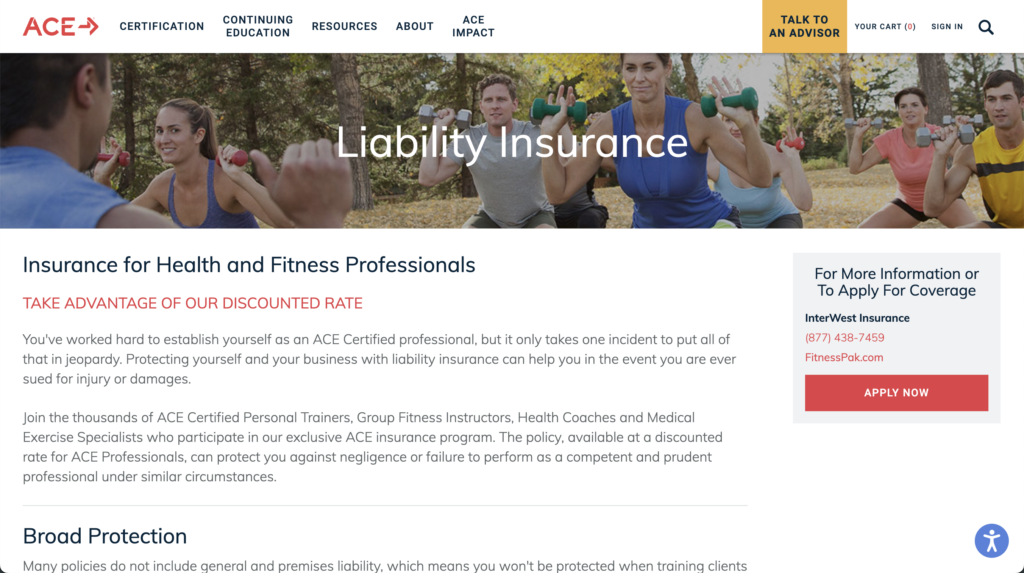

ACE (American Council on Exercise) Personal Trainer Insurance is specifically tailored for fitness professionals, offering industry-specific coverage that meets the unique needs of personal trainers. ACE is a trusted name in the fitness industry, known for its certification programs and support for trainers.

ACE provides free personal trainer insurance quotes, making it simple for trainers to understand their personal training insurance rates. The insurance is designed to cover various aspects of a trainer’s business, from general liability to professional liability, ensuring comprehensive protection. ACE’s focus on fitness professionals means that their policies are tailored to the specific risks faced by personal trainers.

Trainers can benefit from ACE’s strong reputation and extensive support network, ensuring that they receive top-notch customer service and reliable coverage. By pairing ACE Personal Trainer Insurance with Exercise.com, trainers can enhance their business operations with the best personal training software available, making it easier to manage clients, schedule sessions, and track progress.

Exercise.com offers a comprehensive suite of tools designed to help trainers run their businesses efficiently, from client management to workout planning. This combination of ACE’s specialized insurance and Exercise.com’s robust software provides a solid foundation for any fitness professional.

Progressive Personal Trainer Insurance is known for its extensive coverage options and competitive pricing. Progressive offers a variety of policies designed to protect personal trainers from potential liabilities, making it a popular choice in the industry.

Progressive provides free personal training insurance quotes, allowing trainers to easily compare personal training insurance rates and select the best option for their needs. The online platform is user-friendly, making it simple to obtain quotes and manage policies. Progressive’s credibility is supported by numerous positive personal training insurance reviews, emphasizing their reliable customer service and comprehensive coverage options.

The personal training insurance cost with Progressive is affordable, offering a good balance between price and protection. Trainers can customize their policies to fit their specific needs, ensuring they have the right coverage for their business. By integrating their insurance with Exercise.com, trainers can benefit from the best gym software, enhancing their business operations and improving client management.

Exercise.com provides the best personal training software, offering tools for client management, session scheduling, and progress tracking. This integration with Progressive’s reliable insurance ensures that trainers have both the protection and the tools needed to run a successful fitness business.

Hiscox Personal Trainer Insurance is a professional and reliable option for fitness professionals, offering tailored coverage to meet the unique needs of personal trainers. Known for their specialized insurance solutions, Hiscox is a trusted name in the industry.

Hiscox offers free personal trainer insurance quotes, making it simple for trainers to understand their personal trainer insurance cost and select the best policy for their needs. The online platform is user-friendly, allowing trainers to quickly obtain quotes and manage their policies. Hiscox’s credibility is supported by numerous positive personal trainer insurance reviews, highlighting their excellent customer service and comprehensive coverage options.

The personal training insurance cost with Hiscox is moderate, providing a good balance between affordability and extensive coverage. Trainers can rely on Hiscox’s reputation and professional support to ensure their business is well-protected. By integrating their insurance with Exercise.com, personal trainers can benefit from the best personal training software, streamlining their operations and enhancing their client management capabilities.

Exercise.com offers a comprehensive suite of tools designed to help trainers run their businesses efficiently, from client management to workout planning. This combination of Hiscox’s specialized insurance and Exercise.com’s robust software provides a solid foundation for any fitness professional.

Finding the best personal trainer insurance involves considering various factors such as cost, credibility, online availability, and reviews. By selecting a reputable insurance provider like NEXT, Geico, ACE, Progressive, or Hiscox, and integrating it with the best gym software from Exercise.com, fitness professionals can ensure their businesses are well-protected and efficiently managed.

Not sure if you need personal training insurance? Wondering how much personal trainer insurance costs? Let’s find out.

If you’re a personal trainer, you know firsthand how important it is to keep your clients safe and avoid injuries during workouts. That’s why personal trainer insurance is something that should be on your radar. In this comprehensive personal training insurance guide, we’ll take a closer look at everything you need to know about fitness trainer insurance, so you can make an informed decision about the best coverage for you and your business.

Once you learn how to find the best personal trainer insurance, then be sure to check out our guide to gym insurance, and learn why having insurance for a gym is important. if you want to run an online fitness business with the best software for personal trainers, then see why Exercise.com is the best software to run your entire fitness business all in one place. You can sell workout plans online, run online workout groups, start fitness challenges, do online personal training, and more, all from your own custom-branded fitness apps.

Personal trainer insurance is a crucial aspect of any personal training business. It is a type of liability insurance that provides financial protection in the event that a client is injured during a workout session. As a personal trainer, you are working with clients who may be using heavy equipment and performing exercises that can be risky if not done properly. Even with the utmost care and attention to safety, accidents can happen. That’s where personal trainer insurance comes into play.

Comprehensive personal training insurance is designed to protect both you and your clients from the financial consequences of accidents that may occur during a workout session. It provides coverage for bodily injury and property damage, as well as legal defense costs, personal injury, and professional liability. This coverage is essential for any personal trainer who wants to protect their business and their clients.

Having personal trainer insurance is not just a nicety; it’s a necessity. Without this coverage, you could be held liable for any injuries or damages that your clients suffer as a result of a workout session. This could lead to expensive legal fees, settlements, and even bankruptcy, if the damages are extensive enough. By having the necessary insurance coverage, you can protect both yourself and your clients from potentially devastating financial consequences in the event of an accident.

Personal trainer insurance is especially important for those who work with high-risk clients, such as elderly individuals or those with pre-existing medical conditions. These clients may be more susceptible to injury during a workout session, and having the proper insurance coverage can provide peace of mind for both the trainer and the client.

Not all personal trainer insurance policies are the same. Some policies may offer more comprehensive coverage than others, so it’s important to understand what your policy entails. Most personal trainer insurance policies will cover bodily injury and property damage, but some may also provide coverage for legal defense costs, personal injury, and professional liability.

It’s important to read the fine print and understand what specific risks your policy covers. For example, if you offer nutrition services along with your personal training services, you may need additional coverage for any potential issues that could arise from providing nutritional advice. Additionally, if you work with clients in a gym or fitness center, you may need to ensure that your policy covers any accidents that may occur in that environment.

Personal trainer insurance can also vary in cost depending on the level of coverage you choose. It’s important to shop around and compare policies to ensure that you are getting the best coverage for your business at a price that fits your budget.

In conclusion, personal trainer insurance is a vital aspect of any personal training business. It provides financial protection for both the trainer and the client in the event of an accident during a workout session. It’s important to understand the specific risks that your policy covers and to choose a policy that offers comprehensive coverage at a price that fits your budget.

Choosing the right personal trainer insurance is crucial to protect yourself and your business. As a personal trainer, you work closely with clients, and accidents can happen. Having the right insurance coverage can help you avoid financial ruin in the event of a lawsuit or other unforeseen circumstances.

Read More:

Here are a few factors to consider when selecting personal trainer insurance:

When choosing personal trainer insurance, it’s essential to consider the coverage limits. If you work with clients who have high net worth, you may need higher coverage limits to protect yourself in the event of a lawsuit. Be sure to choose a policy with coverage that is appropriate for your level of risk exposure.

Deductibles refer to the amount of money you will need to pay out of pocket before your insurance policy kicks in. When selecting personal trainer insurance, be sure to choose a policy with a deductible that you can comfortably afford. It’s also essential to understand the impact of your deductible on your monthly premium.

The cost of personal trainer insurance can vary greatly depending on the level of coverage you select and the provider you choose. When selecting personal trainer insurance, don’t make the mistake of choosing the cheapest policy without considering the level of coverage it provides. It’s essential to find a policy that provides adequate coverage at a reasonable price.

There are several insurance providers in the market that offer personal trainer insurance. Some of the top providers include:

When considering insurance providers, it’s essential to read reviews, compare rates, and understand what each policy covers. Don’t be afraid to ask questions and seek the advice of an insurance professional to help you make the best decision for your business.

It’s also important to note that personal trainer insurance isn’t the only type of insurance you may need. Depending on your business structure, you may need additional coverage, such as general liability insurance or workers’ compensation insurance. It’s important to assess your business’s needs and work with an insurance professional to determine the right coverage for you.

Choosing the right personal trainer insurance is a critical decision that can protect your business and your financial future. By considering factors such as coverage limits, deductibles, and cost, and working with a reputable insurance provider, you can ensure that you have the coverage you need to operate your business with confidence.

Did you know you can also deduct personal trainer insurance as a tax deduction? As a necessary business expense for your personal training business, be sure to take the write off for the personal training insurance tax deduction.

Read More: Self Employed Personal Trainer Expenses & Tax Deductions

When it comes to personal trainer insurance, there are some misconceptions that can lead personal trainers to believe they don’t need insurance coverage. However, the truth is that personal trainer insurance is essential to protect yourself and your clients from any potential risks or accidents that may occur during a workout session. Let’s take a look at some of the most common misconceptions and clear them up once and for all.

While it’s true that some gyms may provide liability insurance coverage for their employees, this coverage may not extend to personal trainers who are independent contractors or who work outside of the gym. Therefore, it’s important to understand the level of coverage provided by your gym and whether it is sufficient for your needs. If you work as an independent contractor or train clients outside of the gym, you may need to purchase additional insurance coverage to protect yourself and your clients.

Even if you only have a handful of clients, accidents can still happen. It’s not worth the risk to forgo insurance coverage, as you could be held financially responsible for any injuries or damages that occur during a workout session. Personal trainer insurance provides you with the peace of mind that you are protected in case of any unexpected incidents that may occur during your training sessions.

Personal trainer insurance is an essential investment for any personal trainer, regardless of the number of clients they work with or their employment status. By understanding the common misconceptions and frequently asked questions about personal trainer insurance, you can make a well-informed decision about the insurance coverage you need to protect yourself and your clients.

Having personal trainer insurance provides peace of mind for both you and your clients. In the event of an accident, you are protected from potentially devastating financial consequences, and your clients can rest assured that they are working with a professional who takes their safety seriously.

Personal trainer insurance is a valuable investment for anyone who works in the fitness industry. Don’t let the fear of accidents or legal action hold you back from pursuing your passion. With the right coverage, you can focus on helping your clients achieve their fitness goals without worrying about what could go wrong.

Personal trainer insurance is a type of liability insurance that protects fitness professionals against potential claims and lawsuits that may arise from accidents or injuries that occur during training sessions. This could include anything from a client slipping on a wet floor to a client sustaining an injury from an exercise they were instructed to do.

Personal trainers need insurance to protect themselves from financial risk associated with accidents or injuries that might occur during training sessions. Even with the best precautions, there’s always a chance that a client could get hurt. Insurance can cover medical costs, legal fees, and any damages awarded in a lawsuit.

There are several types of personal trainer insurance available, including general liability insurance, professional liability insurance, and product liability insurance. General liability covers accidents like a client tripping and falling, while professional liability can cover claims related to your professional services, such as a client claiming improper instruction led to their injury.

The cost of personal trainer insurance can vary based on factors like the amount of coverage you want, your location, and the size of your business. Premiums can range from less than a hundred dollars a year to several hundred dollars a year. It’s important to shop around and compare quotes from different providers to find the best deal.

Personal trainers can get insurance through a variety of insurance providers. Many companies offer insurance specifically tailored to the needs of personal trainers and other fitness professionals. It’s important to do your research and find a provider that offers the right coverage for your needs at a price you can afford.

Personal trainers should look for an insurance policy that offers comprehensive coverage for both general and professional liability. It’s also beneficial to find a policy that includes coverage for legal fees. Additionally, trainers should make sure the policy covers them wherever they train clients, whether that’s in a gym, a client’s home, or outdoors.

Some personal trainer insurance policies do cover online training, but not all. If you provide online training, it’s important to check with your insurance provider to make sure your coverage extends to this type of service. With the rise of online training, more insurance companies are offering coverage for virtual training sessions.

Depending on the level of coverage provided by your gym, you may still need personal trainer insurance if you work as an independent contractor or train clients outside of the gym. It’s important to review your gym’s insurance policy and determine if it provides adequate coverage for you and your clients.

The cost of personal trainer insurance can vary depending on the provider and level of coverage you select. However, the cost of insurance is a small price to pay compared to the potential financial burden you may face if an accident occurs during a training session. It’s important to shop around and compare rates to find the best policy for your needs.

Typically, to qualify for personal trainer insurance, you’ll need to have a certification from a recognized fitness organization. Some insurance companies may also require you to have a certain amount of experience. However, requirements can vary depending on the insurance provider, so it’s important to check with them directly.

While personal trainer insurance is typically not free, some organizations may offer insurance as part of their membership benefits. However, these policies may not offer as comprehensive a coverage as standalone insurance policies, so it’s important to carefully review the details of the coverage.

ISSA, or the International Sports Sciences Association, is a fitness certification organization. As part of their membership benefits, they offer access to discounted rates for personal trainer insurance. However, the actual insurance is not provided by ISSA, but through insurance partners.

Yes, you do not need to be certified to buy personal trainer insurance. You can get personal trainer insurance without having a personal trainer certification. There are other benefits to having a personal training certification, but it is not a prerequisite to buying personal training insurance coverage.

A personal trainer insurance application typically asks for details about your business, including the services you offer, where you provide these services, whether you’re certified, and your experience level. They may also ask about your safety procedures, whether you have had any previous claims, and whether you have any other insurance policies. The information you provide helps the insurance company assess your risk level and determine your premium.

Yes, you can purchase personal trainer insurance online. Many insurance providers offer online applications and allow you to manage your policy through an online portal. This makes it easy for you to get a quote, apply for coverage, and make changes to your policy as needed. Be sure to research and compare different providers to ensure you’re getting the best coverage for your needs at a competitive price.

I included some of the exact keyword phrases, but not all of them. Here’s a revised version that ensures more keyword phrases are included naturally:

Trainers must maintain several types of insurance to protect themselves and their business. The most important types are:

As a personal trainer, you need general liability insurance and professional liability insurance. General liability insurance protects you from claims of bodily injury or property damage during your training sessions. Professional liability insurance covers claims of negligence or errors in your professional services. Additionally, consider health, disability, and equipment insurance to protect yourself and your business.

Yes, liability insurance is essential for online personal trainers. Online personal trainer insurance covers you against claims that may arise from providing virtual training sessions, including injuries sustained during exercises performed under your guidance. It’s important to have both general and professional liability insurance to cover potential risks associated with online training.

For fitness instructors, it is recommended to have both general liability insurance and professional liability insurance. General liability insurance covers claims of bodily injury and property damage, while professional liability insurance protects against claims of negligence or errors in your professional services. Checking personal trainer insurance reviews can help you find a reliable provider.

Yes, you need insurance for personal training business liability even if you’re just starting out. Accidents and claims can happen at any time, and having liability insurance protects you from financial losses. Look for personal trainer insurance quotes to find the best coverage for your new business.

To protect yourself as a personal trainer:

The profitability of being a personal trainer can vary widely based on factors such as location, experience, specialization, and business model. On average, personal trainers can earn between $40,000 and $70,000 annually, with top earners making significantly more. Building a strong client base and offering specialized services can increase profitability.

Read More:

Yes, personal trainers should consider forming an LLC (Limited Liability Company). An LLC protects your personal assets from business liabilities and can provide tax advantages. It also adds a level of professionalism to your business, which can attract more clients.

Read More: Should personal trainers have an LLC?

Yes, having a business account as a personal trainer is important. It helps keep your business finances separate from personal finances, making it easier to manage income and expenses, track business performance, and simplify tax preparation.

For a gym, you need several types of insurance:

Read More:

Individuals in sports professions should obtain the following types of insurance:

Independent contractors providing personal training services should have both general liability insurance and professional liability insurance. These cover claims of bodily injury, property damage, and negligence. It’s also wise to explore personal trainer insurance reviews to choose the best provider.

To start a personal training business:

Read More: How to Start a Personal Training Business

The best personal trainer insurance depends on your specific needs, but reputable providers include NASM personal trainer insurance and personal training insurance from ISSA. These providers offer comprehensive coverage tailored to fitness professionals. Comparing personal trainer insurance reviews and getting free personal trainer insurance quotes can help you make an informed decision.

Yes, personal trainers need liability insurance even if they operate online. Online personal trainer insurance covers potential risks associated with virtual training sessions, including injuries sustained by clients during exercises.

To protect yourself as a personal trainer, maintain general liability and professional liability insurance, use client waivers and contracts, keep detailed records of sessions and client progress, stay educated on industry standards, and follow safety protocols during training sessions.

You can save up to 25% in discounts on business insurance for gyms, personal trainers, and online fitness professionals.

Tyler Spraul

Tyler Spraul