52+ Self Employed Personal Trainer Expenses (Tax Write-Off Gold!) in 2025

If you’re a self-employed personal trainer, understanding common personal trainer expenses and personal trainer tax deductions is crucial for keeping more of what you earn and building a sustainable business.

Many personal trainers operate as independent contractors, which means they are responsible for reporting their income and expenses to the IRS—and yes, there are plenty of personal trainer tax write-offs available! Personal trainer taxes can be overwhelming without a system in place, especially if you’re new to self-employment. As a freelance personal trainer or self employed fitness instructor, you’re likely providing services on a fee-for-service basis, which means you’re responsible for tracking income, expenses, and filing self-employed personal trainer taxes.

So, what can personal trainers claim on tax? A wide range of personal trainer allowable expenses and tax write offs for personal trainers may be deductible, including continuing education, liability insurance, fitness equipment, travel to client sessions, workout apparel, gym rental space, software tools, and even a business credit card for personal trainer-related purchases. Some of the most common fitness instructor tax write offs include scheduling software, client management platforms, and marketing costs. Fitness instructor tax deductions may also include home office space and mileage if you travel to train clients. And yes—things like yoga instructor tax deductions, Pilates instructor tax deductions, and zumba instructor tax deductions generally follow the same tax rules.

One common question is, “Can personal trainers write off gym memberships?” The answer: only if the membership is required for your business, such as if you rent space or need access to train clients. Personal trainer insurance by the month is another expense that may be deductible, as well as tools used to manage scheduling and payments. And don’t forget planning costs for a personal trainer business—branding, website development, and even your accountant may qualify. Working with a personal trainer accountant who understands the fitness industry can help ensure you’re aligned with the correct personal trainer tax code and don’t miss valuable deductions.

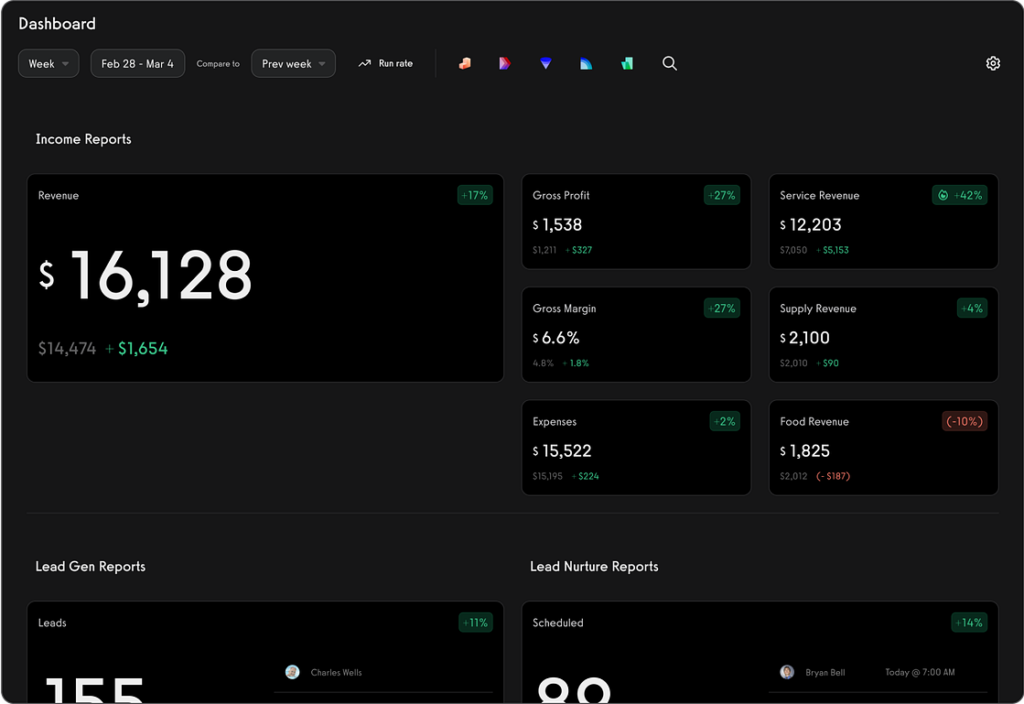

If you’re asking, “What can I write off as a personal trainer?” or “Is a personal trainer tax deductible?”—the key is that the expense must be ordinary and necessary for your work. Having a clear fitness instructor financial plan and knowing your PT expenses (like paying gym rent for personal trainers, for example) will keep you on track. Whether you’re filing under a specific tax code for personal trainer professionals or just starting to track personal trainer tax expenses, staying organized throughout the year is essential. And if you start an online personal training business and sell fitness products online you might also be subject to sales tax! (With Exercise.com all of your fitness sales tax compliance happens automatically in the platform though – whew!)

Exercise.com helps you track income, payments, and scheduling all in one place—making tax season easier and more accurate. With tools that support self-employed trainer workflows and a full gym expenses list at your fingertips, it’s easier to manage your business and maximize personal trainer deductions year-round. Looking to grow your business and stay organized year-round? Book a free demo with Exercise.com to streamline your operations and keep your fitness business running strong.

Read this big list of self employed personal trainer expenses with personal trainer tax deductions you can write off as an expense for your personal training business. As a self-employed personal trainer, it can be hard to navigate the costs and expenses that come along with running your own business. From equipment maintenance to taxes, there are many factors to consider when managing your finances. In this article, we’ll explore the ins and outs of self-employment for personal trainers and the expenses that come with learning how to become a personal trainer that is striking out on their own as a self-employed PT.

Once you learn all about self employed personal training expenses, what you can write off as personal trainer tax deductions, and browse through common personal trainer business expenses, then if you want to run an online fitness business with the best software for personal trainers, then see why Exercise.com is the best software to run your entire fitness business all in one place. You can sell workout plans online, run online workout groups, start fitness challenges, do online personal training, and more, all from your own custom-branded fitness apps.

Introduction: Understanding Self-Employed Personal Trainer Taxes

As a freelance personal trainer or fitness instructor, managing your finances properly is just as important as creating effective workout programs for your clients. Personal trainer taxes can be complex since most fitness professionals operate as independent contractors where personal trainers typically provide their services on a fee-for-service basis. Understanding what expenses of a personal trainer are tax-deductible and maximizing your personal trainer tax write offs can significantly impact your bottom line and business success.

Exercise.com is the best software for personal trainers looking to streamline their business operations while maximizing tax benefits. Our all-in-one platform allows you to track expenses, manage clients, process payments, and generate detailed financial reports that make tax season considerably less stressful. By centralizing your business operations, Exercise.com helps you identify and organize deductible expenses that might otherwise be missed.

This comprehensive guide covers everything fitness professionals need to know about self-employed personal trainer taxes, business expenses, and tax deductions. Whether you’re just starting your journey as a fitness instructor or you’re an established personal trainer self employed for years, understanding the financial aspects of your business is crucial for long-term success and profitability.

Personal Trainer Tax Status: Employee vs. Independent Contractor

Before diving into specific deductions, it’s important to understand your tax status. The question “are personal trainers self employed?” depends on your specific working arrangement.

| Employment Status | Characteristics | Tax Implications | Form(s) Received |

|---|---|---|---|

| Employee | • Works set hours determined by the gym • Uses gym’s equipment and facilities • Gym controls how services are performed • Receives benefits (healthcare, paid time off) • Taxes withheld from paycheck | • Limited tax deductions • Employer pays half of Medicare and Social Security taxes • W-2 income reported | W-2 |

| Independent Contractor (Self Employed Trainer) | • Sets own schedule and rates • Uses own methods and programs • Controls how services are delivered • No benefits through gym • No tax withholding | • Eligible for business deductions • Responsible for self-employment tax (15.3%) • Quarterly estimated tax payments required • Can deduct ordinary and necessary business expenses | 1099-NEC/1099-K |

| Business Owner (S-Corp, LLC) | • Operates as a separate business entity • May employ other trainers • Full control over business operations • May pay yourself salary + distributions | • Most tax flexibility • Potential for lower self-employment taxes • More complex tax filing requirements • Enhanced liability protection | Varies by entity type |

According to industry data, approximately 60% of personal trainers operate as independent contractors, while 25% work as employees and 15% have formed their own business entities. The tax code for personal trainers varies based on this classification, with Schedule C (Form 1040) being the primary form for reporting business income and expenses for self-employed fitness professionals.

Exercise.com’s business management software is specifically designed for freelance personal trainers and fitness business owners, providing features that support the unique tax requirements of independent fitness professionals. Our platform helps you maintain the proper documentation needed to substantiate your independent contractor status while maximizing available tax deductions.

Comprehensive List of Personal Trainer Tax Deductions

One of the most common questions fitness professionals ask is “what can I write off as a personal trainer?” The answer encompasses a wide range of expenses that are ordinary and necessary for your fitness business. Below is a comprehensive table of personal trainer allowable expenses and tax write offs for personal trainers:

| Expense Category | Specific Deductible Items | Documentation Needed | Deduction Type | Potential Annual Savings* |

|---|---|---|---|---|

| Education & Certification | • Certification fees and renewals • Continuing education courses • Professional workshops and seminars • Fitness industry conferences • Professional books and subscriptions • Online fitness courses | • Receipts • Course completion certificates • Renewal documentation • Credit card statements | 100% deductible as professional development | $500-$3,000 |

| Equipment & Supplies | • Exercise equipment • Resistance bands and weights • Assessment tools (calipers, etc.) • Training aids and props • Stopwatches and timers • Client tracking software | • Itemized receipts • Proof of business use • Photos of equipment • Depreciation records for large items | 100% deductible or depreciated for items over $2,500 | $1,000-$10,000 |

| Technology & Software | • Exercise.com subscription • Client management software • Accounting software • Website hosting and maintenance • Fitness apps and programs • Computer/tablet for business use | • Monthly subscription receipts • Software licenses • Usage logs | 100% deductible for business use percentage | $1,200-$5,000 |

| Marketing & Advertising | • Business cards and brochures • Website development • Social media advertising • Search engine marketing • Promotional items • Professional photography | • Advertising receipts • Marketing contracts • Social media ad reports • Designer invoices | 100% deductible as marketing expense | $1,000-$7,500 |

| Travel & Transportation | • Mileage between clients • Parking fees and tolls • Public transportation costs • Travel to fitness conferences • Hotel costs for business events | • Mileage log • Receipts for parking/tolls • Conference registration • Hotel folios | Mileage: Standard rate (58.5¢ per mile in 2022) Other travel: 100% for business purposes | $2,000-$8,000 |

| Home Office | • Dedicated workspace in home • Utilities percentage • Internet percentage • Home office furniture • Storage for fitness equipment | • Home office square footage • Total home square footage • Utility bills • Internet bills • Photos of space | Simplified: $5 per square foot (max 300 sq ft) Regular: Percentage of home used for business | $500-$2,500 |

| Insurance | • Professional liability insurance • Business insurance • Health insurance premiums • Disability insurance | • Insurance policy documents • Premium payment receipts • Personal trainer insurance by the month receipts | 100% deductible for business insurance Self-employed health insurance on Form 1040 | $1,000-$5,000 |

| Professional Services | • Personal trainer accountant fees • Legal services • Business banking fees • Tax preparation costs • Bookkeeping services | • Professional invoices • Service contracts • Payment receipts | 100% deductible as business expense | $500-$3,000 |

| Clothing & Laundry | • Branded workout attire • Training shoes (business use) • Uniforms with logo • Dry cleaning/laundry of work clothes | • Receipts with business purpose noted • Photos of branded items | 100% deductible if specifically for business and not suitable for everyday use | $200-$1,500 |

| Client-Related Expenses | • Refreshments for clients • Client appreciation gifts • Client assessment materials • Printing client workout plans | • Itemized receipts • Client meeting notes • Gift receipts with client names | 100% deductible for business-related items Gifts limited to $25 per person annually | $300-$2,000 |

| Memberships & Dues | • Professional organization dues • Chamber of Commerce membership • Networking group fees • Fitness facility access for client training | • Membership cards • Annual dues statements • Payment receipts | 100% deductible for business-related memberships | $200-$2,000 |

| Health & Wellness | • Gym memberships (business use) • Personal fitness equipment • Wellness services related to your profession | • Detailed purpose documentation • Business use evidence • Connection to professional services | Potentially deductible with strong business purpose documentation | $0-$2,000 |

*Potential annual savings based on 25% effective tax rate. Actual savings will vary based on individual circumstances, income level, and tax bracket.

Can personal trainers write off gym memberships? The answer is nuanced. If the membership is specifically for business purposes (e.g., to train clients or test workouts), it may be deductible with proper documentation establishing the business purpose. Personal use of a gym would not qualify.

Exercise.com’s expense tracking features make it easy to categorize and document all these potential deductions, helping fitness professionals maximize their tax savings. Our platform allows you to tag expenses, attach digital receipts, and generate expense reports categorized by these deduction types—making tax preparation significantly more efficient.

Special Considerations for Different Fitness Specialties

Different fitness specialties may have unique tax deduction opportunities. Here’s how tax write offs for fitness instructors vary by specialty:

| Fitness Specialty | Unique Deductible Expenses | Average Annual Deductions | Notes |

|---|---|---|---|

| Yoga Instructor | • Yoga instructor tax deductions include specialized mats and props • Meditation cushions and blocks • Yoga-specific continuing education • Specialized yoga music and playlists • Studio rental for classes | $3,000-$7,000 | Specialized clothing must be suitable only for professional instruction, not general wear |

| Pilates Instructor | • Pilates instructor tax deductions include reformer maintenance • Specialized small equipment • Pilates certification renewals • Studio space for private sessions | $4,000-$12,000 | Equipment depreciation can be significant for Pilates instructors who own reformers |

| Zumba Instructor | • Zumba instructor tax deductions include music licensing fees • Specialized footwear • Choreography materials • Zumba convention attendance | $2,000-$5,000 | Music licensing is a critical deduction that is often overlooked |

| Group Fitness Instructor | • Music licensing and playlists • Microphone systems • Group instruction certifications • Demo equipment for classes | $2,500-$6,000 | Technology for virtual class instruction has become increasingly deductible |

| Online/Virtual Trainer | • Video production equipment • Lighting for video recording • Enhanced internet services • Additional technology for online delivery | $3,000-$8,000 | Home office deduction typically higher for virtual trainers |

| Sports-Specific Coach | • Sport-specific equipment • Specialized timing devices • Competition entry fees (if business-related) • Sport-specific research materials | $3,500-$9,000 | Travel expenses for competitions may be deductible if business purpose is established |

Exercise.com’s platform is uniquely designed to support all fitness specialties with customizable features that align with these different business models. Our software helps you track specialty-specific expenses and maintain proper documentation for these unique tax deductions, regardless of whether you’re claiming fitness instructor tax deductions as a yoga teacher or Zumba instructor.

Self-Employment Tax Considerations for Fitness Professionals

Self employed fitness instructors face additional tax responsibilities beyond just income tax. Understanding the self-employment tax is crucial for financial planning:

| Tax Component | Rate (2022) | Calculation Base | Notes |

|---|---|---|---|

| Social Security Tax | 12.4% | Up to $147,000 (2022) in net earnings | Employees pay half (6.2%) with employer paying the other half |

| Medicare Tax | 2.9% | All net earnings (no cap) | Employees pay half (1.45%) with employer paying the other half |

| Additional Medicare Tax | 0.9% | Earnings above $200,000 (single) or $250,000 (married filing jointly) | Only applies to high earners |

| Total Self-Employment Tax | 15.3% | Net business profit | Self-employed individuals pay both the employee and employer portions |

How to Reduce Self-Employment Tax:

- Form an S-Corporation: Once your business reaches sufficient profit (typically $40,000+), forming an S-Corporation can reduce self-employment taxes by allowing you to pay yourself a reasonable salary (subject to employment taxes) with remaining profits taken as distributions (not subject to self-employment tax).

- Maximize Business Deductions: Every legitimate business expense reduces your net profit, which is the basis for calculating self-employment tax.

- Retirement Plan Contributions: Contributions to a SEP-IRA, Solo 401(k), or SIMPLE IRA reduce your taxable income (though not self-employment tax directly).

Exercise.com’s comprehensive financial reporting makes it easier to monitor your profitability throughout the year and make strategic decisions about business structure and tax planning. Our platform integrates with popular accounting software, allowing for seamless financial management and tax preparation.

Planning Costs for a Personal Trainer: Start-Up and Ongoing Expenses

Whether you’re just starting out or looking to optimize your existing business, understanding the typical expenses of a personal trainer is crucial for creating a personal trainer financial plan:

Start-Up Costs

| Expense Category | Low-End Investment | Average Investment | High-End Investment | Notes |

|---|---|---|---|---|

| Certifications & Education | $500 | $1,200 | $3,000 | Entry-level vs. specialized advanced certifications |

| Insurance | $200 | $500 | $1,200 | Varies by coverage limits and specialty |

| Basic Equipment | $500 | $2,000 | $10,000+ | Depends on specialty and training style |

| Business Formation | $100 | $500 | $2,000 | Sole proprietorship vs. LLC/Corporation formation |

| Website & Marketing | $300 | $1,500 | $5,000 | DIY vs. professional development |

| Software & Technology | $600 | $1,200 | $3,000 | Exercise.com comprehensive solution vs. multiple platforms |

| Initial Clothing/Uniforms | $200 | $500 | $1,000 | Basic vs. custom branded |

| Business Cards/Branding | $100 | $300 | $1,500 | Basic printing vs. complete brand package |

| Total Initial Investment | $2,500 | $7,700 | $26,700+ |

Ongoing Monthly Expenses

| Expense Category | Low-End | Average | High-End | Annual Total (Average) |

|---|---|---|---|---|

| Liability Insurance | $15 | $40 | $100 | $480 |

| Business Software | $30 | $99 | $299 | $1,188 |

| Continuing Education | $10 | $50 | $200 | $600 |

| Marketing | $50 | $300 | $1,000 | $3,600 |

| Equipment Maintenance | $20 | $50 | $200 | $600 |

| Professional Memberships | $10 | $30 | $75 | $360 |

| Cell Phone (Business Portion) | $20 | $50 | $100 | $600 |

| Travel/Mileage | $100 | $250 | $500 | $3,000 |

| Office Supplies | $20 | $50 | $100 | $600 |

| Professional Services | $50 | $150 | $500 | $1,800 |

| Total Monthly Expenses | $325 | $1,069 | $3,074 | $12,828 |

These gym expenses list items represent typical costs, but your specific expenses will vary based on your business model, location, and specialty. Exercise.com helps personal trainers manage and optimize these expenses through comprehensive business management tools that provide clear visibility into your financial performance.

Read More: Personal Trainer Insurance

Tax Filing Requirements for Self-Employed Personal Trainers

Self-employed personal trainer taxes involve several specific forms and filing requirements:

| Form | Purpose | Filing Deadline | Notes |

|---|---|---|---|

| Schedule C (Form 1040) | Report business income and expenses | April 15 (or extended due date) | Primary form for reporting business profit/loss |

| Schedule SE (Form 1040) | Calculate self-employment tax | April 15 (or extended due date) | Based on net profit from Schedule C |

| Form 1040-ES | Quarterly estimated tax payments | April 15, June 15, Sept. 15, Jan. 15 | Required if you’ll owe $1,000+ in taxes |

| Form 4562 | Depreciation and amortization | With annual tax return | For equipment over $2,500 or when using Section 179 |

| Schedule 1 (Form 1040) | Additional income and adjustments | With annual tax return | Includes self-employed health insurance deduction |

| Form 8829 | Home office expenses | With annual tax return | If using regular method instead of simplified |

| Form 1099-NEC/1099-K | Received from clients/platforms | Provided by Jan. 31 | Report of income paid to you |

Record-Keeping Requirements:

| Record Type | Retention Period | Format | Notes |

|---|---|---|---|

| Tax Returns | 7 years | Digital/Paper | Keep all filed forms and supporting documents |

| Expense Receipts | 7 years | Digital/Paper | Organized by category for efficient retrieval |

| Income Records | 7 years | Digital/Paper | Client payments, 1099s, income statements |

| Mileage Log | 7 years | Digital/Paper | Date, purpose, starting/ending odometer, miles |

| Asset Records | Life of asset + 7 years | Digital/Paper | Purchase documents, depreciation records |

| Business Formation Documents | Indefinitely | Digital/Paper | LLC agreements, business licenses, permits |

Exercise.com’s comprehensive reporting and digital receipt storage help you maintain these critical records in a secure, organized system. Our platform allows you to attach digital receipts to expenses, maintain service records, and generate reports that align with tax categories—making tax preparation significantly more efficient.

Business Banking and Credit for Personal Trainers

Establishing proper financial infrastructure is essential for tax compliance and business management:

| Financial Tool | Purpose | Tax Benefit | Recommendation |

|---|---|---|---|

| Separate Business Checking | Segregate business and personal finances | Creates clear audit trail for business expenses | Essential for all fitness professionals |

| Business Credit Card for Personal Trainer | Track business expenses, build business credit | Organized statements for categorizing deductions | Recommended for consistent expenses |

| Business Savings Account | Reserve funds for taxes and large purchases | Segregate tax obligations from operating funds | Essential for tax management |

| Accounting Software | Track income, expenses, and tax deductions | Automated categorization of potential deductions | Integrates with Exercise.com |

| Payment Processing | Accept client payments professionally | Clear income tracking and reporting | Built into Exercise.com platform |

Using a business credit card for personal trainer expenses creates an automatic record of purchases that can be categorized as deductions. When selecting a card, look for:

- No annual fee or low fee options

- Cash back on common personal trainer expense categories

- Business-specific benefits

- Expense categorization features

Exercise.com’s payment processing and financial tracking integrate seamlessly with your business banking, creating a complete financial ecosystem that simplifies bookkeeping and tax preparation.

Using Exercise.com to Maximize Tax Benefits

Exercise.com is the best software solution for personal trainers looking to maximize tax benefits while streamlining their business operations:

| Exercise.com Feature | Tax Benefit | Potential Tax Saving |

|---|---|---|

| Expense Tracking | Categorize and document deductible expenses | Prevents missed deductions worth $1,000-$5,000 annually |

| Digital Receipt Storage | IRS-compliant documentation of expenses | Provides audit protection and substantiation |

| Payment Processing | Accurate income tracking and reporting | Prevents income reporting errors that trigger audits |

| Client Management | Documentation of business relationships | Supports independent contractor status |

| Service Tracking | Clear records of services provided | Substantiates business purpose of expenses |

| Financial Reporting | Year-end and quarterly tax preparation reports | Reduces accounting fees by $300-$1,200 annually |

| Business Analytics | Identify profit trends and tax planning opportunities | Optimizes timing of purchases and entity decisions |

| Integrated Marketing | Track and categorize marketing expenses | Ensures marketing deductions are properly documented |

By centralizing your business operations in Exercise.com’s platform, you create a comprehensive system that not only simplifies tax compliance but also identifies additional deduction opportunities that might otherwise be missed.

Taking Control of Your Fitness Business Finances

Understanding personal trainer taxes and maximizing your eligible deductions is not just about compliance—it’s about optimizing your business profitability. By properly tracking expenses, maintaining thorough documentation, and utilizing the right business tools, fitness professionals can save thousands in taxes annually while building a more sustainable business.

Exercise.com provides the comprehensive business management platform that fitness professionals need to streamline operations, maximize tax benefits, and focus on what matters most—delivering exceptional services to clients. Our all-in-one solution eliminates the need for multiple software subscriptions while providing the detailed financial tracking necessary for tax optimization.

Whether you’re just starting out or looking to optimize an established fitness business, implementing proper financial practices and leveraging Exercise.com’s business management tools will position you for long-term success. Take control of your fitness business finances today and transform tax season from a stressful obligation to an opportunity for business optimization.

List of 52+ Personal Trainer Expenses

Read through this list of common personal trainer expenses for tax deduction purposes, and then make sure you are claiming all appropriate write offs on your personal training business tax return.

- Fitness equipment purchase or lease

- Equipment maintenance and repairs

- Professional development and continuing education

- Fitness certification renewal fees

- Insurance: health, liability, and property

- Rent for gym or studio space

- Utilities (if renting a private space)

- Marketing and advertising expenses

- Website development and maintenance

- Professional photography for marketing

- Social media management tools

- Membership fees for fitness organizations

- Professional services like accounting or legal

- Health and fitness software subscription (like Exercise.com)

- Music licensing for classes

- Travel expenses for client visits

- Office supplies

- Business cards and other printed promotional materials

- Personal training clothing and uniforms

- Cleaning supplies for equipment and facilities

- Business license fees

- Taxes

- Internet and phone bills

- Computer and office equipment

- Mobile devices (smartphones, tablets) for business use

- Transportation costs (fuel, maintenance, insurance, etc.)

- Refreshments for clients (water, protein bars, etc.)

- Fitness journals and planners for clients

- Subscriptions to health and fitness publications

- Fitness DVDs, books, and other resources

- Bank fees related to your business account

- Payroll expenses if you hire other trainers or administrative staff

- Retirement contributions

- Employee benefits if you have staff (health insurance, worker’s compensation, etc.)

- Cost of hiring subcontractors (other trainers, cleaning staff, etc.)

- Business consulting services

- Interest on business loans

- Depreciation of business assets

- Home office expenses (if applicable)

- Fitness assessment tools (heart rate monitors, body composition analyzers, etc.)

- Specialty equipment for niche markets (yoga mats, Pilates equipment, boxing gloves, etc.)

- Software for creating workout plans and tracking client progress

- Legal fees for drafting waivers and contracts

- Networking event fees

- Client gifts and incentives

- Gym bag and other personal gear for work

- Cost of music or other media used in training sessions

- Fees for payment processing or credit card transactions

- Postage and delivery for mailing items to clients

- Safety equipment like first aid kits

- Subscriptions for fitness apps used in training.

- Nutrition and meal planning software.

- Costs of health or wellness workshops and seminars.

- Costs related to maintaining a clean and safe training environment (sanitizers, wipes, etc.).

- Fees for online fitness platforms for virtual training.

- Exercise.com software!

Read More:

- Best Personal Training Software

- Gym Owner Tax Deductions

- Gym Equipment Depreciation Guide

- Accounting for Gyms

- Personal Trainer Insurance

- How do you make a workout program and sell it?

- Best Custom-Branded Fitness Apps Software

- How to Make Money Selling Workout Plans Online

Common Self-Employed Personal Trainer Expenses & Deductions

- Fitness Equipment & Supplies: Dumbbells, resistance bands, yoga mats, foam rollers, etc.

- Professional Development: Certification courses, CEUs, seminars, and online training programs.

- Insurance: Personal trainer insurance by the month is tax deductible.

- Travel & Transportation: Mileage for driving to client sessions, parking, tolls, and travel for business-related events.

- Marketing & Website Costs: Fitness website hosting, social media ads, flyers, business cards, etc.

- Gym Rent or Studio Fees: If you rent space, that’s a deductible expense under your self-employed personal trainer taxes.

- Business Credit Card Interest: Using a business credit card for personal trainer expenses can offer trackable deductions.

- Software & Subscriptions: Fitness apps, workout programming tools, scheduling software like Exercise.com.

- Uniforms/Workout Apparel: Clothing required for training may be partially deductible if it’s branded or only used for business.

Can You Write Off Personal Training?

If you’re offering training services, your business expenses—including certifications, equipment, and client-facing tools—are generally deductible. But what about clients who ask, “Can you write off personal training on taxes?” Unless it’s medically necessary and prescribed by a doctor, clients cannot typically deduct personal training sessions. However, personal trainers themselves can deduct most of their business-related costs.

Other Fitness Professionals Who Qualify for Deductions

- Yoga instructor tax deductions

- Pilates instructor tax deductions

- Zumba instructor tax deductions

- Self-employed fitness instructors of any kind

Helpful Tax Codes & Resources

- Tax code for personal trainer: Generally classified under “Fitness & Recreational Sports Centers” or “Other Personal Services.”

- Personal trainer accountant: Hiring a CPA who understands personal trainer tax deductions can help maximize savings.

Tip: Keep an accurate record of all income and expenses using bookkeeping tools or fitness business management software like Exercise.com to simplify your financial tracking and tax season.

Want to scale your fitness business with software for both in-person and online growth? Get a demo now!

Understanding Self-Employment for Personal Trainers

Defining Self-Employment

Self-employment is a popular career choice for personal trainers who want to have more control over their work and schedule. Essentially, it means that you work for yourself rather than for an employer. As a self-employed personal trainer, you are responsible for finding clients, scheduling appointments, and managing all aspects of your business. This can be challenging, but it can also offer a great deal of flexibility and control.

One of the biggest advantages of self-employment is that you have the freedom to set your own rates and choose the types of clients you want to work with. This means that you can tailor your services to meet the needs of your clients and build a business that aligns with your personal values and goals.

Benefits of Being a Self-Employed Personal Trainer

There are many benefits to being a self-employed personal trainer. For starters, you have complete control over your schedule. This means that you can work as much or as little as you want, depending on your personal and professional goals. You can also take time off when you need it, without having to worry about getting approval from a boss or manager.

In addition to having more flexibility, self-employed personal trainers also have the ability to set their own rates. This means that you can charge what you feel your services are worth, rather than being limited by a salary or hourly wage. You can also choose the types of clients you want to work with and tailor your services to meet their needs. This can help you build a loyal client base and establish yourself as an expert in your field.

Another benefit of self-employment is the ability to deduct certain expenses from your taxes. As a personal trainer, you may be able to deduct expenses such as gym memberships, equipment purchases, and travel expenses related to your business. This can help reduce your overall tax burden and increase your take-home pay.

Challenges of Self-Employment in the Fitness Industry

While there are many benefits to self-employment, there are also some challenges to consider. For example, it can be challenging to find clients and build a steady stream of income. As a self-employed personal trainer, you will need to be proactive in marketing your services and building your client base. This may involve networking, advertising, and offering promotions or discounts to attract new clients.

Another challenge of self-employment is the need to handle all aspects of your business. This includes tasks such as marketing, accounting, and administrative work. While you may be an expert in personal training, you may not have the same level of expertise in these areas. This can be time-consuming and stressful, especially if you are trying to balance these tasks with your personal and professional life.

Despite these challenges, many personal trainers find that self-employment is a rewarding and fulfilling career choice. By taking control of your work and schedule, you can build a business that aligns with your personal values and goals. With hard work and dedication, you can create a successful and thriving business as a self-employed personal trainer.

Essential Expenses for Self-Employed Personal Trainers

Being a self-employed personal trainer can be a rewarding and fulfilling career, but it also comes with its own set of expenses. In order to run a successful business, it’s important to understand the essential expenses that come with being a personal trainer. Here are some additional details on the expenses mentioned above:

Equipment and Maintenance Costs

When it comes to purchasing equipment, it’s important to invest in high-quality items that will last. While this may seem like a large upfront cost, it will save you money in the long run by avoiding frequent replacements. In addition to purchasing equipment, you’ll also need to budget for regular maintenance and repairs. This can include things like replacing worn-out resistance bands or getting your weightlifting equipment serviced.

Insurance and Liability Coverage

While insurance and liability coverage may seem like an unnecessary expense, it’s crucial for protecting your business and your clients. General liability insurance will protect you in case a client is injured while working with you, and professional liability insurance can protect you in case of a lawsuit related to your services. Workers’ compensation insurance is also important if you have any employees. Keep in mind that the cost of these policies will vary depending on the size of your business and the level of coverage you need.

Read More: Best Personal Trainer Insurance

Marketing and Advertising Expenses

When it comes to marketing and advertising, it’s important to create a cohesive brand that accurately represents your business. This can include creating a professional website, running targeted social media ads, and designing eye-catching business cards or flyers. Ongoing marketing and advertising campaigns can also help you reach new clients and grow your business over time.

Read More: How do I promote my fitness brand?

Certification and Continuing Education Fees

Continuing education is crucial for personal trainers who want to stay up-to-date with the latest industry trends and techniques. While certification programs and continuing education courses can be expensive, they are necessary for maintaining your professional knowledge and skills. Consider budgeting for these fees on a regular basis to ensure that you are always providing the best possible service to your clients.

Travel and Transportation Costs

When it comes to working with clients in different locations, transportation costs can add up quickly. If you use your own vehicle, you’ll need to account for fuel, insurance, and maintenance costs. You may also need to consider public transportation or ride-sharing services if you don’t have your own vehicle. Keep in mind that these costs can vary depending on the distance you need to travel and the frequency of your visits to different locations.

By understanding and budgeting for these essential expenses, you can set yourself up for success as a self-employed personal trainer. Remember that investing in your business now can lead to long-term success and growth.

Tax Deductions and Financial Planning

As a self-employed personal trainer, you have the flexibility to set your own schedule, choose your clients, and build your business on your own terms. However, with this freedom comes the responsibility of managing your finances and taxes. Understanding tax deductions and financial planning can help you maximize your savings and build a strong financial foundation for your business.

Read More: Gym Owner Tax Deductions

Common Tax Deductions for Personal Trainers

One of the key benefits of being self-employed is the ability to take advantage of tax deductions. As a personal trainer, there are several deductions you may be eligible for, including:

- Home office expenses: If you work from home, you may be able to deduct a portion of your rent or mortgage, utilities, and other expenses related to your home office.

- Equipment purchases: If you buy equipment for your business, such as weights, resistance bands, or exercise mats, you may be able to deduct the cost of these items.

- Marketing and advertising expenses: If you spend money on marketing and advertising, such as creating flyers or running Facebook ads, you may be able to deduct these expenses.

- Professional development: If you attend conferences or workshops to improve your skills as a personal trainer, you may be able to deduct the cost of these events.

It’s important to work with a tax professional to understand which deductions you qualify for and how to maximize your savings. By taking advantage of these deductions, you can lower your taxable income and keep more money in your pocket.

Record-Keeping and Expense Tracking

In order to take advantage of tax deductions and properly manage your finances, it’s essential to keep accurate records and track your expenses. This can include:

- Saving receipts: Keep all receipts related to your business expenses, such as equipment purchases, marketing expenses, and professional development events.

- Tracking mileage: If you use your personal vehicle for business purposes, such as traveling to client appointments or attending networking events, you may be able to deduct the cost of mileage. Keep track of your mileage by recording the date, destination, and purpose of each trip.

- Using accounting software: Consider using accounting software, such as QuickBooks or FreshBooks, to stay organized and track your income and expenses. This can help you better understand your cash flow and make informed decisions about your business.

By keeping track of your expenses, you can ensure that you’re taking advantage of all eligible deductions and maximizing your savings. Plus, having organized records can make tax season much less stressful.

Hiring a Financial Advisor or Accountant

If you’re not comfortable managing your finances on your own, consider hiring a financial advisor or accountant. These professionals can help you create a budget, track your expenses, and plan for your financial future. While this may be an additional expense, it can be well worth the investment in the long run.

A financial advisor can help you make informed decisions about investing your money, planning for retirement, and managing your debt. An accountant can help you prepare your taxes and ensure that you’re taking advantage of all eligible deductions. By working with these professionals, you can feel confident that your finances are in good hands.

Budgeting and Financial Management Tips

Being a self-employed personal trainer can be a rewarding career, but it also requires careful financial management. In this article, we’ll explore some tips for creating a realistic budget, saving for emergencies, and investing in your business and personal growth.

Creating a Realistic Budget

When it comes to budgeting, it’s important to be realistic about your income and expenses. Start by tracking your monthly income, including revenue from training sessions, online coaching, and any other sources of income. Next, list out your expenses, both fixed (such as rent, utilities, and insurance) and variable (such as marketing expenses and equipment purchases).

Once you have a clear picture of your income and expenses, you can determine how much you can afford to spend each month. Be sure to leave some wiggle room for unexpected expenses, such as repairs or equipment replacement.

It’s also a good idea to set financial goals for yourself, such as paying off debt or saving for a down payment on a house. By having specific goals in mind, you’ll be more motivated to stick to your budget.

Saving for Emergencies and Unexpected Expenses

As a self-employed personal trainer, it’s important to have a financial cushion to fall back on in case of emergencies or unexpected expenses. This can include anything from a sudden drop in clients to a major equipment breakdown.

Consider setting up a separate savings account specifically for emergencies. Aim to save at least three to six months’ worth of living expenses in this account. You can contribute to it regularly, either with a set amount each month or a percentage of your income.

Having an emergency fund can give you peace of mind and help you weather any financial storms that come your way.

Investing in Your Business and Personal Growth

Finally, don’t forget to invest in your business and personal growth. This can include attending conferences, taking courses, and hiring a coach or mentor.

Attending industry conferences can be a great way to stay up-to-date on the latest trends and best practices in the fitness industry. You can also network with other professionals and potentially find new clients or business opportunities.

Taking courses or certifications can help you develop new skills and expand your offerings as a personal trainer. For example, you might take a course in nutrition coaching or specialize in working with clients with specific health conditions.

Hiring a coach or mentor can provide you with valuable guidance and support as you navigate the ups and downs of running a business. They can help you set and achieve goals, stay accountable, and provide a sounding board for new ideas.

By investing in your business and personal growth, you’ll be better equipped to provide high-quality services to your clients and stay motivated and engaged in your work.

Can a personal trainer be a business expense?

Yes, if you hire a personal trainer specifically for research, to learn techniques for your clients, or for direct business purposes, it may qualify as a deductible business expense. However, personal fitness training primarily for your own health would not qualify. Proper documentation of the business purpose is essential.

Is a personal trainer tax deductible for clients?

Generally, personal training expenses are not tax-deductible for individual clients. However, if a doctor prescribes personal training as treatment for a specific medical condition, the client may be able to claim it as a medical expense (subject to AGI thresholds). For businesses, can you write off personal training on taxes? Yes, if it’s part of a qualified employee wellness program.

What can personal trainers claim on tax?

Personal trainers can claim all ordinary and necessary business expenses including certification costs, equipment, insurance, marketing, travel between clients, home office expenses, and business software like Exercise.com. The key is proper documentation and establishing the business purpose of each expense.

What are the tax write offs for personal trainers who operate virtually?

Virtual trainers can deduct home office expenses, internet costs, video equipment, lighting, enhanced audio equipment, and software platforms necessary for online training. Exercise.com’s virtual training features are fully tax-deductible as a necessary business expense for online trainers.

Can a personal trainer write off supplements?

Personal trainers may be able to write off supplements if they can prove they are a necessary business expense. However, it’s important to consult with a tax professional as tax laws can vary.

Can a personal trainer deduct workout clothes?

Generally, clothing that can be worn outside of work isn’t deductible. Specialized gear that’s necessary for work, like branded uniforms, might be. Consult with a tax professional to understand what’s deductible.

Is a personal training certification (NASM, ACE, etc.) tax deductible?

Yes, costs associated with obtaining a necessary certification for your profession, like a personal training certification, are typically tax deductible.

What are personal trainers NOT allowed to deduct on their taxes?

Personal trainers cannot deduct personal expenses, such as personal gym memberships, general clothing not specifically for work, personal meals, or commuting costs. Again, always consult with a tax professional.

Is it better to be a self-employed personal trainer?

It depends. Being self-employed offers more control over your schedule, clients, and rates. However, it also means handling business expenses, marketing, and potentially less job security.

Can I write off Exercise.com personal training software?

Yes, as a necessary expense for managing your business, Exercise.com software would typically be tax-deductible.

Can I write off personal training liability insurance?

Yes, liability insurance is a necessary business expense and typically tax-deductible.

Read More: Best Personal Trainer Insurance

Can I write off personal training advertising/marketing expenses?

Yes, advertising and marketing are necessary for acquiring clients and are generally tax-deductible.

How can Exercise.com software help my personal training business?

Exercise.com software can enhance your personal training business by streamlining your business operations. It offers tools for scheduling, payment processing, workout creation and delivery, client and class management, and progress tracking, all from your own custom branded fitness app. It also provides a platform for virtual training, which is critical in today’s fitness industry. It’s like a personal assistant for your fitness business. Plus, it’s customizable to fit your brand and needs, giving you a professional and efficient platform to grow your business.

Read More:

- Best Personal Training Software

- How to Make a Fitness App

- How do I create an online fitness platform?

Grow Your Personal Training Business

Managing your finances as a self-employed personal trainer requires careful planning and attention to detail. By creating a realistic budget, saving for emergencies, and investing in your business and personal growth, you can build a successful and fulfilling career in the fitness industry.

Want to get seeing how Exercise.com can help you get started taking your personal training business to the next level with software?