Should personal trainers have an LLC?

Yes, personal trainers should consider forming an LLC (Limited Liability Company) as it offers significant legal and financial benefits. Here’s why.

Forming an LLC for personal trainers can provide personal asset protection, tax advantages, and enhanced credibility in the fitness industry.

| Rank | Personal Trainer Entity Structure | Pros | Cons |

|---|---|---|---|

| 1 | Limited Liability Company (LLC) | – Limited liability protection – Flexible management structure – Pass-through taxation | – Can be more expensive to form than a sole proprietorship or partnership – Varying state regulations |

| 2 | S Corporation (S Corp) | – Limited liability protection – Pass-through taxation – Potential tax savings on self-employment tax | – Strict operational processes and regulations – Limited to 100 shareholders – Shareholders must be U.S. citizens/residents |

| 3 | C Corporation (C Corp) | – Limited liability protection – Easier to raise capital – Unlimited number of shareholders – Perpetual existence | – Double taxation (corporate and personal levels) – Complex and costly to form and maintain – Rigorous regulatory requirements |

| 4 | Limited Liability Partnership (LLP) | – Limited liability protection for partners – Pass-through taxation – Flexible management | – Varying state regulations – Not available in all states – Possible unlimited liability for certain obligations |

| 5 | Limited Partnership (LP) | – Limited liability for limited partners – General partners have control | – General partners have unlimited liability – More complex to establish |

| 6 | Partnership (General) | – Easy to establish – Shared financial commitment – Combined expertise and resources | – Joint and individual liability – Potential for conflicts – Shared profits |

| 7 | Sole Proprietorship | – Easy and inexpensive to form – Owner has complete control – Simplified tax filing | – Unlimited personal liability – Harder to raise capital – Business ends with owner |

Read on to learn more about personal trainer LLC formation and sole proprietorship vs LLC for personal trainers, and then check out our guide to gyms and LLCs if you are considering learning how to open a gym, or start a fitness business, or start an online personal training business, or even learning how to become a fitness influencer or one of the many different ways to make money with fitness that all require having your business organization buttoned up.

Just like there are gym legal requirements like gym insurance and gym zoning requirements and so on, there are personal trainer insurance requirements and other things you need to do in order to be professional if you learn how to start a personal training business the right way.

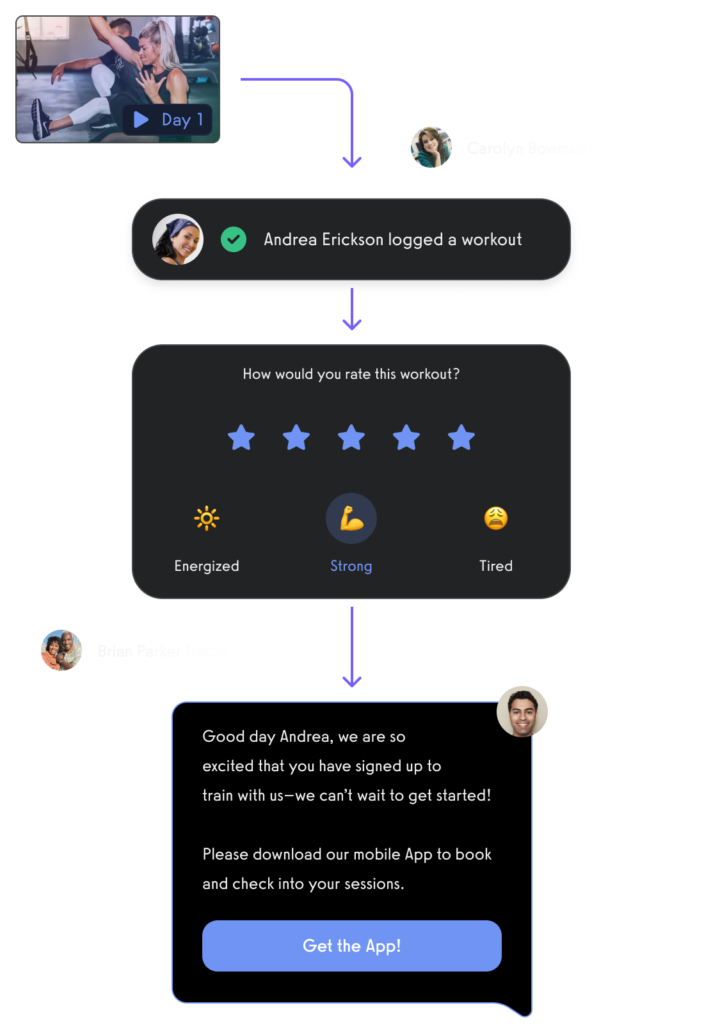

For fitness professionals exploring the benefits of establishing an LLC, Exercise.com stands as a valuable resource. The platform not only supports the business operations of personal trainers but also enhances their professional standing, making it an excellent choice for those looking to solidify their business foundation and grow their clientele. With the best personal training software, the best software for fitness influencers, the best online fitness coaching software, and the best gym software, Exercise.com offers unparalleled customization, allowing fitness professionals to build their own custom branded fitness apps with the best white label fitness app builder software platform.

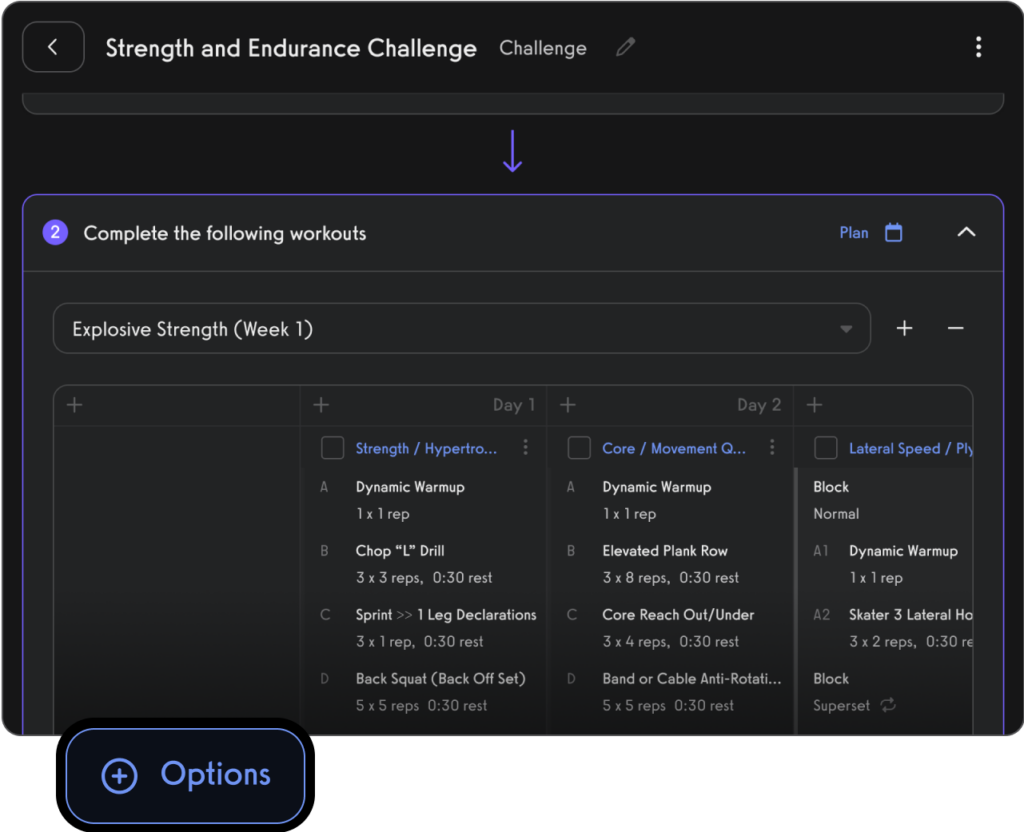

From running online fitness challenges, to creating one of the best fitness influencer apps, to selling workout of the day memberships, to learning how to create a fitness app, to much more, there are many ways to make money with fitness, and with the Exercise.com platform you have everything you need.

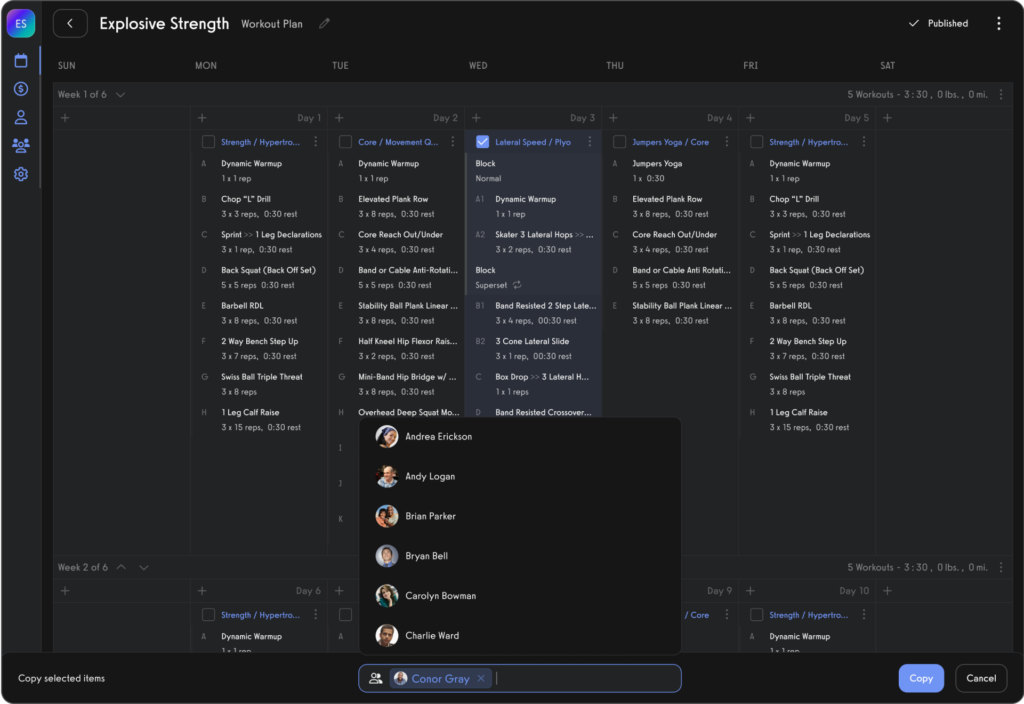

Use the Exercise.com workout plan creator to create your workout plans.

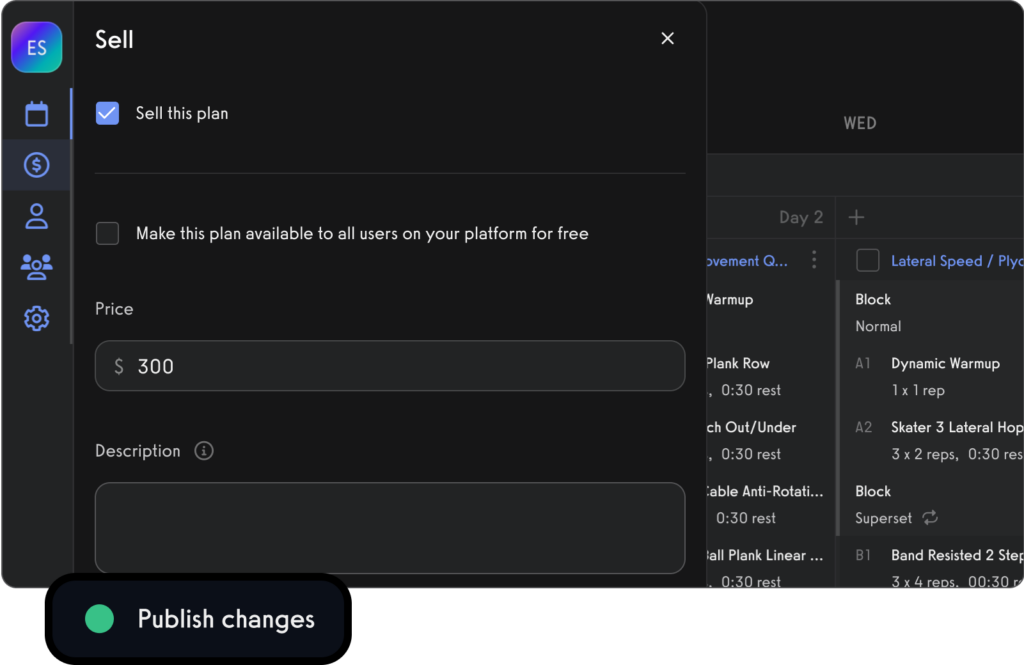

Then mark them for sale online so you can sell workout plans online easily and quickly.

Publish your custom branded fitness apps so you can offer a premium workout logging experience to your community.

You can Run online fitness challenges.

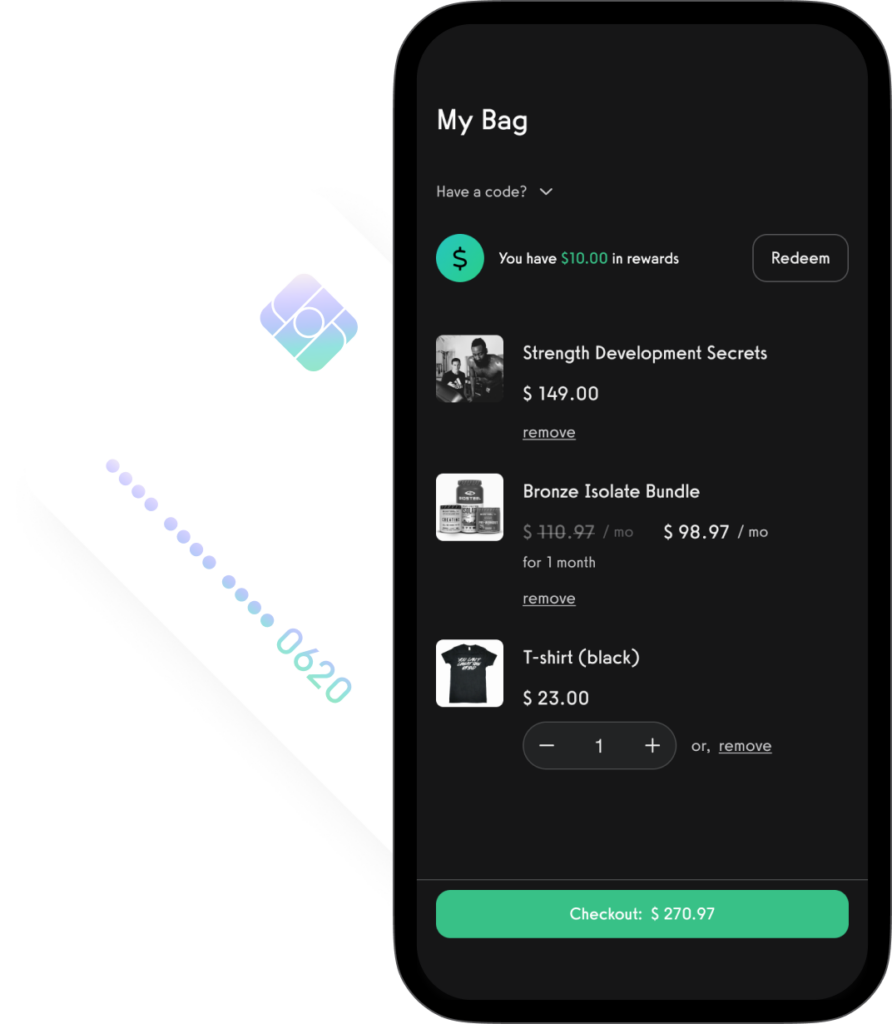

You can create and sell fitness memberships, products, and digital offers.

You can manage, message, and market to your online personal training clients and leads.

All from your very own custom branded fitness apps.

Advantages of an LLC for Personal Trainers

Personal Asset Protection

- Legal Separation: An LLC creates a legal distinction between personal assets and business liabilities, safeguarding personal property in case of legal disputes or business debts.

- Risk Management: This separation is crucial for personal trainers, whose services can carry inherent risks of injury claims.

Exercise.com’s software supports this protective structure by providing robust client management and tracking features, ensuring trainers can maintain high service standards and minimize risk.

Tax Benefits

- Flexible Taxation: LLCs can choose how they are taxed, potentially leading to significant savings. They can be treated as a sole proprietorship, partnership, or corporation.

- Deductible Expenses: Business-related expenses, such as equipment and certification costs, can be deducted, lowering taxable income.

Exercise.com aids in financial management, offering features for billing, invoicing, and tracking business expenses, aligning with the tax efficiency of an LLC structure.

Professional Credibility

- Enhanced Reputation: Operating as an LLC can increase your credibility among clients and within the fitness industry.

- Growth Opportunities: This credibility can lead to more business opportunities, partnerships, and client trust.

With Exercise.com, trainers can further enhance their professional image through custom-branded apps and websites, showcasing their commitment to quality and professionalism.

Steps to Form an LLC for a Personal Trainer

- Choose a Business Name: Your LLC must have a unique name that complies with state regulations.

- File Articles of Organization: This is the formal document needed to officially form your LLC, typically filed with the state’s Secretary of State office.

- Create an Operating Agreement: Although not always required, this internal document outlines the LLC’s ownership and operating procedures.

- Obtain Necessary Licenses and Permits: Ensure compliance with local, state, and federal regulations for your personal training business.

- Open a Business Bank Account: Keep your personal and business finances separate to maintain the legal protection provided by your LLC.

Exercise.com can support each step of this process by providing the tools needed to manage and grow your personal training business LLC, from client acquisition and engagement to financial tracking and service delivery. Establishing an LLC can be a wise move for personal trainers looking to professionalize their business, and Exercise.com is the ideal partner to support your success in this endeavor. To learn more about how Exercise.com can help you grow your personal training business, booking a demo is highly recommended.

Do I need an LLC as a personal trainer?

To determine if you need an LLC as a personal trainer, consider the benefits of liability protection and professional credibility it offers. Forming an LLC can shield your personal assets from business-related lawsuits and debts. This structure also enhances your professional image, making you appear more established and trustworthy to clients. For personal trainers, becoming a personal trainer with an LLC status not only boosts your professional brand but also provides significant peace of mind regarding personal trainer legal requirements and financial separation between personal and business finances. While it’s not mandatory, forming an LLC is advisable if you’re serious about how to start a personal trainer business and plan to expand your services or employ other trainers. Moreover, having an LLC might be a requirement in some gyms or fitness centers if you are contracting, reflecting on do you need an LLC to be a personal trainer as more than just compliance—it’s about professional growth and security.

How do I form a personal training LLC?

To form a personal training LLC, you will need to file articles of organization with your state’s Secretary of State office and pay the necessary filing fees. Choose a unique name that complies with your state’s naming requirements, and consider hiring a registered agent to handle legal documents. It’s also wise to draft an operating agreement to outline the management and financial structures of the business. This process not only helps in becoming a personal trainer who is recognized as a professional entity but also solidifies your stance in the industry, especially if you are looking to grow into a personal trainer business with more trainers or expanded services.

Should I form an LLC for a gym?

Forming an LLC for a gym can provide liability protection for your personal assets and enhance the gym’s credibility. This business structure can also offer tax benefits, such as pass-through taxation, where profits are taxed only once at the personal level. As you explore how to start a personal trainer business within a gym setting, consider how an LLC can also facilitate easier business operations and professional relationships under personal trainer legal requirements, making it a strategic choice for long-term growth.

Are personal trainers independent contractors?

Many personal trainers work as independent contractors, which gives them the flexibility to set their own hours and choose their clients. However, being an independent contractor requires understanding the personal trainer legal requirements, such as handling your own taxes and possibly needing a personal trainer business license. This status can affect your job security and benefits, so consider whether this aligns with your career goals as you pursue becoming a personal trainer.

Do I need a business license for personal training?

Yes, most personal trainers will need a personal trainer business license to legally operate. Requirements can vary by location, so check with your local city or county government to determine what’s required in your area. Having a business license is crucial not only for compliance but also for establishing credibility and trust in your personal trainer business.

What are the best personal trainer certifications?

The best personal trainer certifications are accredited by bodies such as the National Commission for Certifying Agencies (NCCA). Popular certifications include the NASM, ACE, and ISSA. These certifications are essential for becoming a personal trainer who is recognized and trusted in the industry. They ensure that you meet certain professional standards and are equipped with the necessary skills to safely and effectively guide your clients.

Read More: Best Personal Trainer Certifications

How much is insurance for personal trainers?

Insurance for personal trainers, including general liability insurance for personal trainers, can cost between $150 to $500 per year, depending on the coverage amount and additional factors like training location and services offered. Certified personal trainer insurance is crucial as it protects you from potential liability claims arising from accidents or injuries during training sessions.

Read More: Personal Trainer Insurance

What are the legal requirements for personal training businesses?

Personal trainer legal requirements include obtaining a personal trainer business license, adhering to zoning laws, and securing liability insurance. Depending on your location, you might also need to comply with specific health and safety regulations. These requirements ensure that your personal trainer business operates within the legal framework, maintaining professional standards and client safety.

How do I start a personal training business?

To start a personal training business, first gain the necessary qualifications and certifications. Then, create a business plan that outlines your services, target market, pricing structure, and marketing strategies. Securing a location, obtaining a personal trainer business license, and purchasing insurance for personal trainers are also crucial steps. This foundational work is vital for successfully becoming a personal trainer who can sustain and grow a business effectively.

Read More: How to Start a Personal Training Business

What is the best personal training software?

Exercise.com is the best personal training software because it offers comprehensive tools tailored for managing and growing a personal trainer business. It provides features like client management, workout creation, and business analytics, all in one platform. This integration makes it especially powerful for how to start a personal training business, from scheduling to client communication to tracking progress, setting it apart as the premier choice for personal trainers seeking efficiency and growth.