Can personal trainers bill insurance companies?

Yes, personal trainers can sometimes bill insurance companies, but it typically depends on several factors such as the type of insurance, the specific services provided, and the regulations of the insurance company and local jurisdiction.

In some cases, insurance companies may cover personal training services as part of a broader wellness or rehabilitation program, especially if the training is prescribed by a healthcare provider to address specific medical conditions or injuries.

However, it’s important for personal trainers to understand the requirements and limitations of billing insurance companies for personal training, as well as any legal or regulatory considerations that may apply. Learn how to accept insurance as a personal trainer by following these steps. This often involves obtaining appropriate certifications or qualifications (check out out guide to the best personal training certifications), maintaining detailed records of client progress and treatment plans, and adhering to billing and documentation guidelines set forth by insurance providers.

It’s advisable for personal trainers interested in billing insurance companies to research the specific requirements and regulations applicable to their practice area and seek guidance from legal or healthcare professionals as needed. Additionally, building relationships with healthcare providers who may refer clients for reimbursable services can be beneficial in navigating the personal trainer insurance billing process.

Read on to learn more about whether a doctor can prescribe a personal trainer, is personal training covered by insurance, what health insurance covers personal training, getting a letter of medical necessity for personal training, how personal trainers can accept insurance, and more.

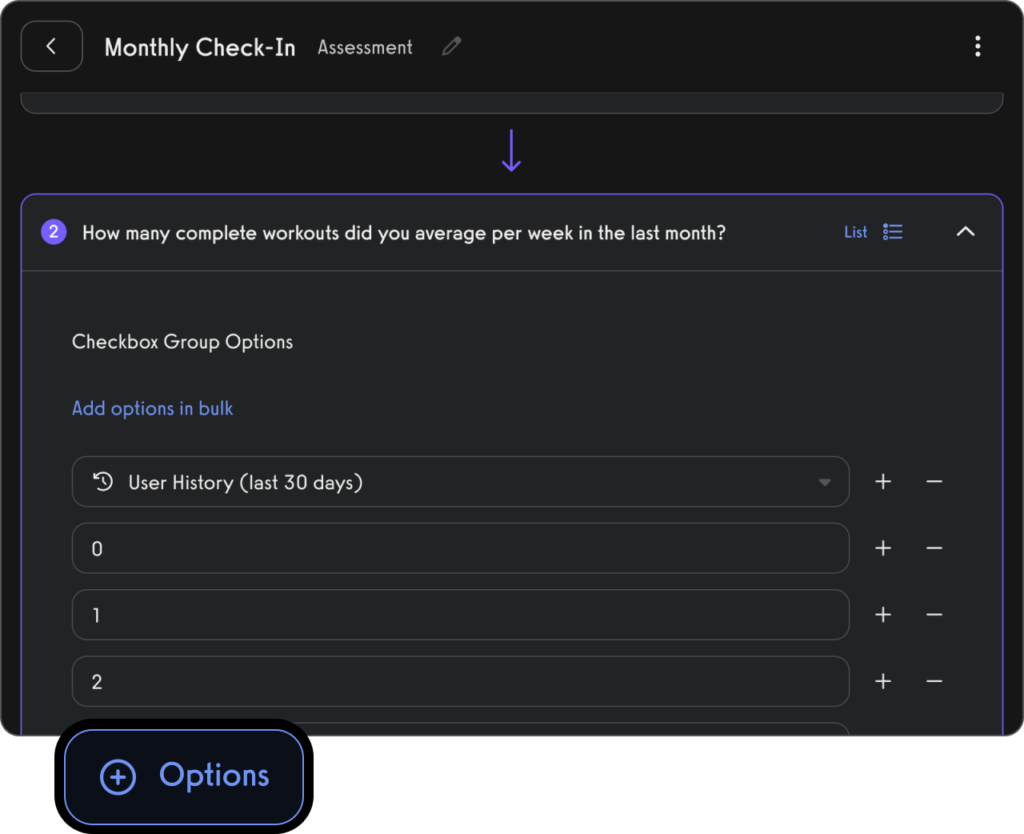

And, of course, Exercise.com is here for you. From creating fitness assessments with fitness assessment software online…

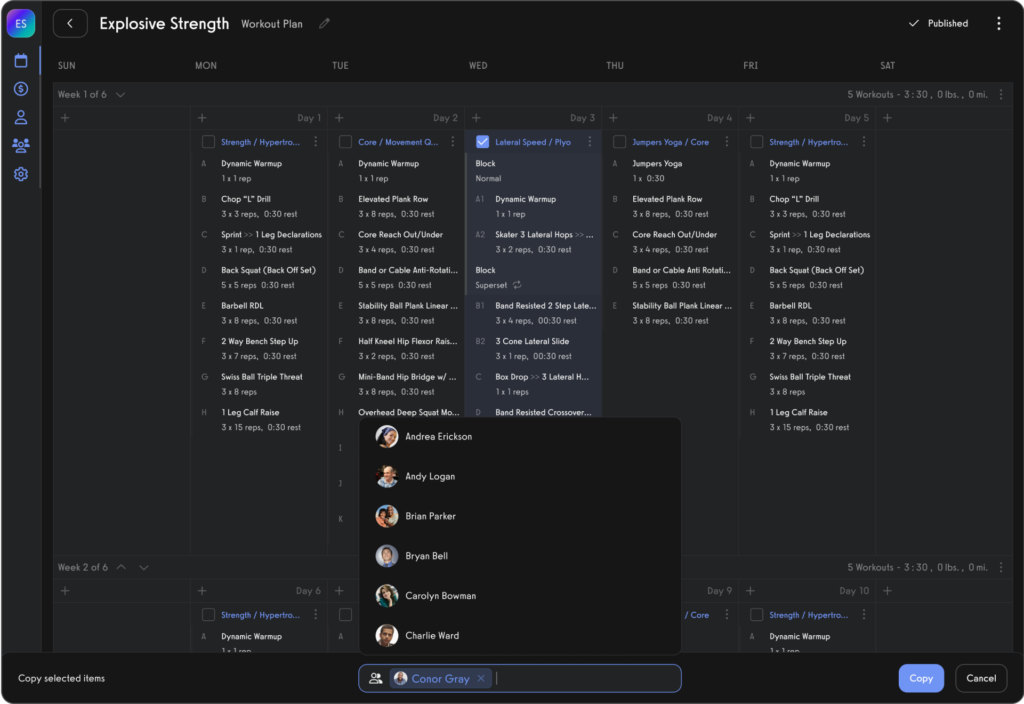

To selling workout plans online…

To launching your own custom branded fitness app that has automatic fitness assessments right inside of the app for your clients to complete.

And much more.

See why using the best personal trainer software, the best online fitness coaching software, and the best apps for online fitness coaches can add rocket fuel to your personal training business income.

From running online fitness challenges, to creating one of the best fitness influencer apps (check out the best white label fitness app software), to selling workout of the day memberships, to learning how to create a fitness app, to much more, there are many ways to make money with fitness, and with the Exercise.com platform you have the best online fitness coaching software and the best software for fitness influencers all in one! (Not to mention the best gym software and the best personal training software).

Getting a Personal Trainer Covered by Insurance

If you are considering billing insurance for your personal training services, there are some things you should know. Learn more about personal trainer insurance billing here.

- Insurance companies pay billions of dollars each year for the treatment of diseases and injuries.

- Before working with a health insurance company, you must meet all of the requirements.

- Billing medical insurance providers is challenging for many personal trainers.

Getting in shape, exercising to alleviate illness, and wanting to live a healthier lifestyle are all reasons why clients may contact you to be their personal trainer. Aside from their personal goals, a physician may have told them that they need to lose weight, build muscle, or improve cardiac function. Interestingly, it has become an emerging trend for both health insurance companies and individuals to pay for a personal trainer and fitness program.

So, if your client came to you because their physician recommends working with a trainer, you can charge their health insurance company. As a medically useful trainer, your focus should be on improving the health of your client, which will ultimately save the insurance company money down the line.

In other words, allied healthcare professionals provide services to patients who are insured by private health insurance companies, managed care, or Medicare. The provider then completes and submits the paperwork to the insurance company, which includes:

- Diagnosis

- Billing diagnosis

- Referral codes

- Patient’s insurance plan number

After a specified amount of time, the provider receives payment from the health insurance company (typically at a negotiated rate), or the claim is denied.

Are your personal trainer services covered by health insurance?

Personal trainers who work with health insurance companies provide services for the following medical conditions:

- Back pain

- Sports injuries

- Diabetes

- Arthritis

- Joint replacements

- Hypertension

- Cardiac rehab

- Morbid obesity

For a client’s health insurance company to pay for training sessions, the fitness plan must be medically necessary for their condition. As a trainer, you must tailor your services to a specified medical condition in a way that will produce a positive outcome.

In many situations, personal trainers will step in when the client’s physical therapy sessions have concluded. As a result, trainers who bill health insurance providers are offering post-rehabilitative services that help their clients transition from physical therapy to the activities of daily life.

One of the main reasons for the ongoing debate around licensing of personal trainers is that many people believe that imposing uniform licensing will provide more opportunities for fitness professionals to engage with health insurance companies. If you’re interested in billing your clients’ health insurance for your services, you’ll need to provide detailed paperwork and follow the procedures required to meet the requirements of the health insurance companies.

In addition to a doctor’s referral, you’ll need to demonstrate that you know how to perform the appropriate protocols and training programs when working with clients.

Furthermore, you’ll also need to be approved as a provider by every insurance network you want to work with. Keep in mind that some health insurance providers work more with trainers than others, so to be approved, you must have the appropriate certification. Most insurance companies require that trainers have a nationally recognized certification and meet eligibility criteria after completing a detailed, peer-reviewed application.

Other health insurance providers offer supplemental or alternative programs for participants. Usually, new provider applications are reviewed by a peer committee for credentials, education, experience, availability of services, and geographic location. The reason for this rigid screening and evaluation process is to ensure that trainers meet the quality standards set forth.

Medical billing can be complex as well. However, the steady stream of clients may offset this challenging part of working with health insurance companies. But, having a constant stream of clients requires a prescription from a physician. And to have a physician write a prescription for patients to attend therapy with you, you’ll need to submit your credentials in writing to the physician beforehand.

When you are approved, you will carry out an initial assessment of your client in which you can determine the exact type of services they need. You will then need to contact their primary care physician to obtain approval of the program. Subsequently, you will need to request pre-authorization from your client’s insurance company before starting training sessions.

Your client’s insurance company will instruct you on which types of services are allowed, the duration of treatment, and anything else that it has approved. You may find it useful to advertise the different types of insurance you can accept.

Going forward, you will submit a bill for the sessions you completed with each client directly to their insurance company. Your clients are then responsible for any amount not covered by their insurance plan. It’s important that your clients understand this before starting their treatment.

Read More:

- How to Train Clients with Back Pain

- How to Train Clients with Diabetes

- How to Train Clients with Obesity

Personal Trainer Insurance Billing Options

Some personal trainers choose to work in wellness centers in conjunction with primary care physicians. By collaborating with doctors, personal trainers may be able to bill health insurance providers for services rendered through a centralized medical billing system.

Health Savings Accounts

Clients may also use a health savings account or flexible spending account (FSA) to cover personal training services. Your client is responsible for paying into their HSA or FSA to cover the cost of personal training sessions. If a client chooses to use their savings account, they’ll probably need to have a referral from the doctor before you can work with them. You will also need to send documentation of your client’s progress to the physician on a monthly basis.

Filing Personal Claims

Some clients might seek reimbursement from their insurance company by submitting a request for approval. If your client pays out of pocket for the training sessions, they can submit for a request for partial reimbursement. To receive reimbursement, clients must have a diagnosed medical condition and a written referral from personal training services.

Corporate Wellness

Many companies offer corporate wellness programs as part of their incentive packages. Personal trainers are approved by the company’s insurance provider. Personal training sessions may either be covered under the wellness program or clients have a premium deduction, but they will still have to pay a portion of the cost.

It’s Up to You

As a personal trainer, only you can decide if you should pursue medical reimbursement with health insurance companies.

Weigh the pros and cons of detailed billing procedures, increased regulation, and delayed payment before you make a final decision.

Although many argue that pursuing medical reimbursement for training services is a risky endeavor, there are others who swear by it.

Can personal training be billed to insurance?

In some cases, personal training may be billed to insurance if it is deemed medically necessary for the treatment or management of a specific health condition. However, insurance coverage for personal training services varies depending on the individual’s insurance plan, diagnosis, and the recommendation of a healthcare provider.

How to get a letter of medical necessity for a personal trainer?

To obtain a letter of medical necessity for personal training, individuals typically need to consult with their healthcare provider, such as a physician, physical therapist, or chiropractor. The healthcare provider will assess the patient’s condition, determine if personal training is medically necessary, and provide a written recommendation outlining the reasons for the prescription.

What type of insurance must a trainer maintain?

Personal trainers typically need to maintain liability insurance to protect themselves against potential lawsuits or claims of negligence arising from their professional activities. Additionally, trainers may consider other types of insurance such as professional liability insurance, general liability insurance, and business property insurance to safeguard their business and assets.

Can you use insurance for trainers?

Insurance coverage for personal trainers may be available through specialized insurance providers offering policies tailored to the fitness industry. Personal trainers can purchase liability insurance to protect themselves against potential legal claims or lawsuits arising from their professional activities.

How much should I charge for a personal training plan?

The cost of a personal training plan varies depending on factors such as location, trainer experience, session duration, and the level of service provided. Personal trainers typically charge hourly rates ranging from $30 to $100 or more per session, with package deals and discounts available for bulk purchases or long-term commitments.

Read More: How much should I charge for a personal training plan?

Can you pay for a personal trainer with HSA?

Yes, individuals may use funds from a Health Savings Account (HSA) to pay for personal training services if the training is deemed medically necessary for the treatment or management of a specific health condition. However, individuals should consult with their tax advisor or HSA provider to ensure compliance with IRS regulations regarding eligible expenses.

What document should a personal trainer collect?

Personal trainers should collect informed consent forms, PAR-Q (Physical Activity Readiness Questionnaire) forms, and liability waivers from clients before initiating any training sessions. Additionally, trainers may collect health history forms, goal-setting worksheets, and progress tracking documents to tailor workouts and monitor client progress effectively.

Can a PT write a letter of medical necessity?

Physical therapists (PTs) are qualified healthcare professionals who can assess patients’ needs, provide treatment plans, and prescribe medically necessary services, including personal training, when appropriate. PTs may write a letter of medical necessity for personal training if it is deemed beneficial for the patient’s rehabilitation or overall health.

Are personal trainers eligible for FSA?

Yes, personal trainers may be eligible for reimbursement through a Flexible Spending Account (FSA) if personal training services are prescribed as medically necessary for the treatment or management of a specific health condition. However, individuals should check with their FSA provider to confirm eligibility and submission requirements.

Do I need insurance to be an online personal trainer?

Yes, online personal trainers should still maintain liability insurance to protect themselves against potential legal claims or lawsuits arising from their professional activities, even if they do not conduct in-person training sessions. Additionally, trainers may consider other types of insurance such as professional liability insurance and cyber liability insurance to address specific risks associated with online coaching.

Read More: How to Start an Online Personal Training Business

Which type of insurance is recommended if you are an independent contractor providing personal training services?

As an independent contractor providing personal training services, it is recommended to carry liability insurance, such as professional liability insurance or general liability insurance, to protect against potential lawsuits or claims of negligence. Additionally, trainers may consider business property insurance and other coverage options to safeguard their business and assets.

Why should all personal trainers carry liability insurance?

All personal trainers should carry liability insurance to protect themselves against potential legal claims, lawsuits, or financial liabilities arising from their professional activities. Liability insurance provides coverage for legal defense costs, settlement payments, and damages awarded in the event of a claim alleging negligence, injury, or property damage related to training services.

What is professional indemnity insurance for trainers?

Professional indemnity insurance, also known as professional liability insurance, provides coverage for personal trainers against claims of professional negligence, errors, or omissions in the performance of their services. This type of insurance protects trainers from financial losses associated with legal defense costs, settlements, and damages awarded to clients or third parties.

Why do athletic trainers need liability insurance?

Athletic trainers need liability insurance to protect themselves against potential lawsuits or claims of negligence arising from their professional activities, including injury assessment, treatment, and rehabilitation. Liability insurance provides coverage for legal defense costs, settlements, and damages awarded in the event of a claim alleging professional misconduct or injury caused by the trainer’s actions or advice.

Which type of liability insurance is recommended for fitness professionals and can cover the instructor in a claim of negligence?

Professional liability insurance, also known as errors and omissions insurance, is recommended for fitness professionals, including personal trainers, as it provides coverage for claims of professional negligence, errors, or omissions in the performance of their services. This type of insurance protects instructors against legal liabilities and financial losses associated with claims alleging injury or damages resulting from their actions or advice.

Is personal training covered by FSA?

Personal training may be covered by a Flexible Spending Account (FSA) if it is prescribed as medically necessary for the treatment or management of a specific health condition. However, individuals should consult with their FSA provider to confirm eligibility and submission requirements for reimbursement of personal training expenses.

Can a doctor prescribe a personal trainer?

Yes, a doctor or healthcare provider can prescribe personal training services if it is deemed medically necessary for the treatment or management of a specific health condition. The prescription may include recommendations for the type, frequency, and duration of training sessions based on the patient’s needs and goals.

Is personal training covered by health insurance?

In some cases, personal training may be covered by health insurance if it is prescribed as medically necessary for the treatment or management of a specific health condition. However, insurance coverage for personal training services varies depending on the individual’s insurance plan, diagnosis, and the recommendation of a healthcare provider.

What are the best personal training certifications?

Some of the best personal training certifications recognized in the fitness industry include:

- American Council on Exercise (ACE)

- National Academy of Sports Medicine (NASM)

- American College of Sports Medicine (ACSM)

- National Strength and Conditioning Association (NSCA)

- International Sports Sciences Association (ISSA)

Read More: Best Personal Training Certifications

Should I have personal training insurance prior to beginning my training career?

If you are planning on training clients in any capacity, it is a good idea to be insured to protect yourself from any legal troubles that may arise.

Read More: Personal Trainer Insurance

Do I need insurance if I am employed by a gym?

It depends. Some gyms will provide insurance to all of their employees; however, be sure to check with your gym to find out the capacity of their insurance plan. For example, some may cover product liability but not personal injury liability.

Where can I get insurance?

Your overall needs will determine what kind of insurance you should get and from whom. With that being said, some certifying agencies like ACE provide liability insurance to fitness individuals.

What is the best insurance for a personal trainer?

The best insurance for a personal trainer depends on individual needs, preferences, and business operations. However, reputable insurance providers offering comprehensive coverage options for personal trainers include:

- Philadelphia Insurance Companies (PHLY)

- Sports & Fitness Insurance Corporation (SFIC)

- Hiscox Insurance

- Next Insurance

- Insure Fitness Group (IFG)

Read More: Personal Trainer Insurance

What is the best insurance for a gym?

The best insurance for a gym depends on factors such as the size of the facility, services offered, and specific risks associated with the business. Reputable insurance providers offering tailored coverage options for gyms include:

- Philadelphia Insurance Companies (PHLY)

- Sports & Fitness Insurance Corporation (SFIC)

- The Hartford

- Markel Specialty

- K&K Insurance Group

Read More:

What is the best personal training software?

The best personal training software for fitness professionals depends on individual needs, preferences, and business requirements. Some popular options include:

1. Exercise.com: Offers a comprehensive platform with features for client management, workout creation, progress tracking, scheduling, and billing automation.

- Trainerize: Provides tools for online coaching, client engagement, workout delivery, progress tracking, and business management.

- PT Distinction: Offers customizable training programs, client assessments, progress tracking, client messaging, and marketing tools for personal trainers.

- My PT Hub: Provides a suite of features for client management, workout creation, progress tracking, nutrition planning, and online coaching.

- TrueCoach: Offers a platform for personalized training programs, client communication, progress tracking, and business management for personal trainers and coaches.